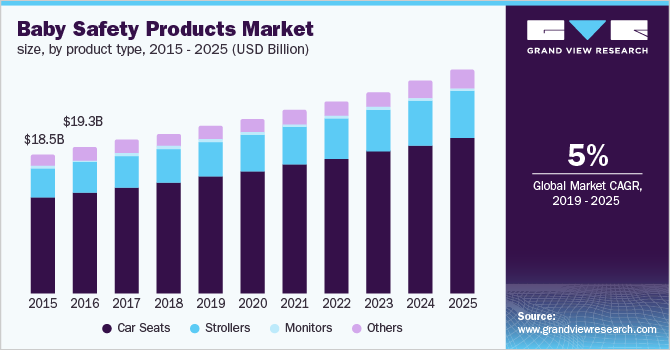

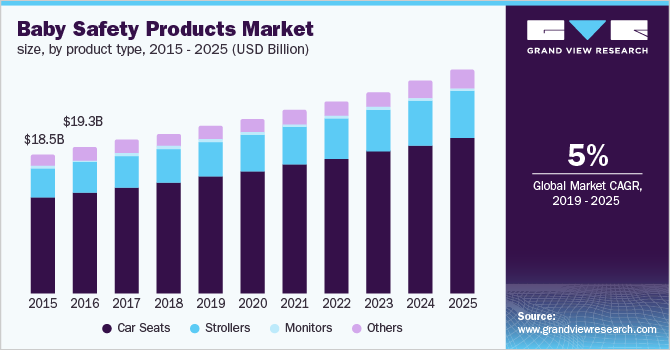

The global baby safety products market size to be valued at USD 132.2 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% during the forecast period. An increasing number of government initiatives to control the rising death incidents among babies have been driving the market. Rising needs and awareness about infant protection, increasing consumer purchasing power, and a noticeable inclination towards nuclear families are the significant factors driving the global market. Moreover, increasing penetration of online retail platforms is positively impacting the sales of baby monitors among consumers.

Technological advancement has introduced devices such as baby monitors that enable real-time communication between parents and babies. Increasing acceptance of these devices among working professionals is expected to drive the market. The online retail network is progressively used by players to increase their prominence to sustain the competition. Security concerns linked with such devices have been recognized to be a challenging factor in the market.

Due to an increase in the number of child deaths, the government is taking preventive initiatives by introducing new rules and safety standards. For instance, in Europe, the United Nations Economic Commission of Europe (UNECE) Regulation No. 44 and Regulation No. 129 have set the standards for child restraint systems and every baby car seat must meet these standards. The government of Europe has set the standards for most baby safety products like beds, cribs, and strollers.

New and innovative product launches are further spurring the market growth and are creating a willingness among consumers to purchase baby safety products. For instance, Baby Jogger launched its new City Tour 2 Double Stroller in May 2019 for twin babies. Halo DreamNest is a 3-in-1 sleep system that can be used as a bassinet, travel cot, and travel crib.

The availability of a wide variety of products in order to meet specific requirements related to the weight and age of babies, along with an increase in popularity of the online channel, is further spurring the growth of the market. The online channel has provided the vendors with an alternative to the traditional brick and mortar store, owing to its benefits of providing a detailed specification of the product.

The market is driven by the rising demand for baby safety products owing to product quality improvements, technological advancements, increase in disposable income and social security policies by the government. Product quality is a significant trend that is expected to have an impact on organic growth throughout the forecast period. Moreover, to improve protection, governments are enacting stricter rules and regulations governing baby safety products. Before introducing the baby safety products, the regulations need a thorough testing. Another trend projected to drive the market throughout the forecast period is the introduction of unique and multi-functionality in baby strollers.

The rising number of working parents and the concern for children safety are the factors supplementing the growth. Furthermore, the introduction of new and innovative products, with a high emphasis on child safety is adding to the demand for baby products.

However, the restrictions are impeding its growth and acting as a roadblock to achieve the growth value. The increased costs of safety products drive the customers away from purchasing the safety accessories. In addition, the public's lack of awareness for the appropriate baby product is a significant stumbling block. The market is hindered by the COVID-19 pandemic, resulting in a stagnant growth.

The high demand for baby safety products is a major reason for the market to boom. The demand is accelerated by the launch of innovative products by key players. The growth is being accelerated by leading players' partnerships with e-commerce platforms. Thus, these factors are likely to create potential opportunities for the baby safety products market in the near future.

The product segment includes car seats, strollers, monitors, and other baby safety products. The baby car seat segment held the largest share of 70.6% in 2018. An increasing number of car accidents have been driving the demand for baby car seats. Moreover, new features in the car seats such as anti-rebound bars to keep the seats steady in case of collision and a foam layer with energy-absorbing features are further attracting the consumers to purchase the product. For instance, Britax Convertible Car Seat comes with three layers of protection, anti-rebound bars, and a click-tight installation system, which ensures the child is seated securely.

The baby monitors segment is expected to expand at the fastest CAGR of 6.6% from 2019 to 2025. The growing population of working parents and the need to track the activities of the babies are driving the demand for this product. These monitors can be connected to smart devices using wireless technology such as Wifi and can be used to interact with and monitor the baby. For instance, Willcare Newborn Baby Monitor comes with a long-range monitor and night vision, along with features such as lullaby tracks, temperature monitors, and a clock. Demand for baby monitors is expected to witness a significant rise in the next few years due to technological advancements and easy deployment.

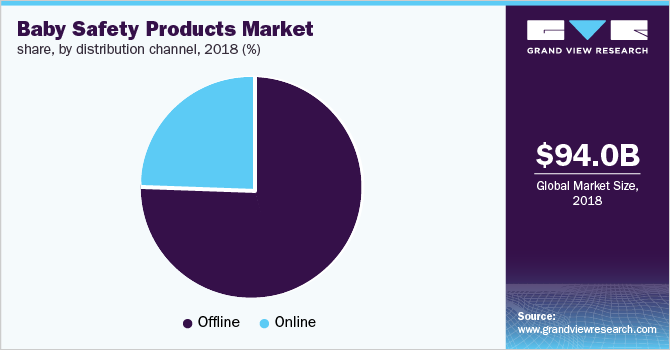

The offline distribution channel held the largest share of more than 70.0% in 2018. The major players in the baby safety products market are generating maximum revenue from offline sales. The significant growth is primarily attributed to benefits offered to the customers such as scanning the product before purchase, availability of a large number of options to choose from, free demonstrations, and guidance from sales executives on choosing the best product. The offline channel includes local stores, hypermarkets and supermarkets, and convenience stores. For instance, First Cry is the largest store in Asia with more than 400 stores in India.

The online distribution channel is expected to exhibit the fastest CAGR of 5.3% from 2019 to 2025. Factors such as an increase in the number of internet users, fast-paced lifestyle, smartphones, and penetration of e-commerce platforms are anticipated to boost the segment growth. Moreover, product comparison features, detailed product overview, and easy exchange and refund options are making customers comfortable with shopping online, thereby driving sales. For instance, The Honest Company Inc., grew 75.0% to approximately 261.1 million USD, BabyHaven.com grew 65% to 53.1 million USD, and Albee Baby grew 5% to 21.3 million USD.

North America held the largest share of 30.7% in 2018. Factors such as high purchasing power, technological advancements, working parents, and government initiatives regarding infant safety have contributed to the growth of the market in North America. According to TABS Industry Report, consumers with an income of more than USD 150,000 showed an increase in penetration for baby products .

In 2017, out of 3,600 Sudden Unexpected Death Syndrome (SUID) in the U.S., 38% of the deaths were due to Sudden Infant Death Syndrome (SIDS) Sudden Infant Death Syndrome, which is about 1400 deaths per year. To control these deaths, the Centers for Disease Control and Prevention (CDC), launched an initiative named Protect the Ones You Love to raise awareness among parents about the causes of child injury, SIDS, and SUID and how they can be prevented.

Asia Pacific is expected to register the highest CAGR of 5.8% from 2019 to 2025. The market in this region is primarily driven by an increase in birth rate and the number of working mothers in countries like China and India. The rise in disposable income and improved standard of living are also the prime factors contributing to the market growth in this region. According to EPRA International Journal of Economic and Business Review, the female workforce participation rate has increased by 4.1% over the last three decades, which is expected to propel the need for various baby safety products such as baby monitors, thereby contributing to the market growth.

The industry is dominated by leading players such as Britax Child Safety, Chicco, Dorel Industries, Baby Cache, Baby’s Dream Furniture, Baby Jogger, Baby Trend, Combi, Cosatto, Graco, and Land of Nod. The growing trend among millennial parents to ensure child safety while traveling is driving the manufacturers to introduce technically advanced products. For instance, baby monitors are equipped with both audio and video technology such as Motorola Halo, Eufy Security SpaceView, and Owlet Cam to ensure security.

Report Attribute

Details

Revenue forecast in 2025