12 expense report templates you can use to keep a record of all your expenses, seek reimbursement, stay on top of your business travel costs, and more.

PDF • Excel • Google Docs

An expense report is a form that lets you track all business-related costs — from employee-incurred expenses to project-specific costs.

This record usually serves as a basis for a cash reimbursement request for the amounts employees spend while on a particular business duty.

However, expense reports can also be used to:

Notable examples of items that should be included in an expense report include:

Here's how expense reporting works in more detail:

An expense report usually consists of:

So, you've understood what expense reports really are and found out more about their purpose.

Now, all you need is a set of reliable expense reports you can use on a regular basis.

Although creating your own expense reports in Excel is an adequate solution, there is a quicker alternative. Instead of creating your own expense report templates manually from scratch — it's always easier to use suitable, ready-made templates.

Here are 12 Expense Report templates you can try right now.

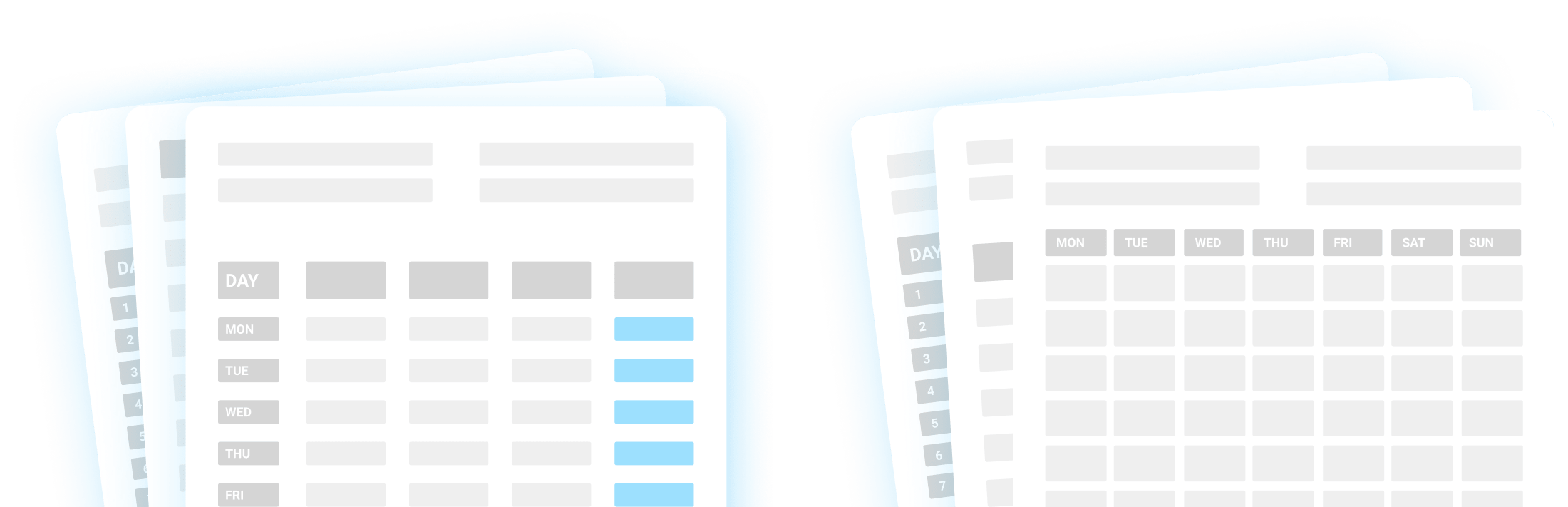

Whenever you need a simple form to help you remain up-to-date with your recent expenses, you can go for a Basic Expense report template.

What is the Basic Expense Report Template?

The Basic Expense Report template lets you organize your basic payment expenses by the:

How to use the Basic Expense Report Template?

Once you enter the amounts you paid for each item, you'll get your expenses calculated by subtotal for each date and total for the whole expense period covered.

The Basic Expense Report Template is best for:

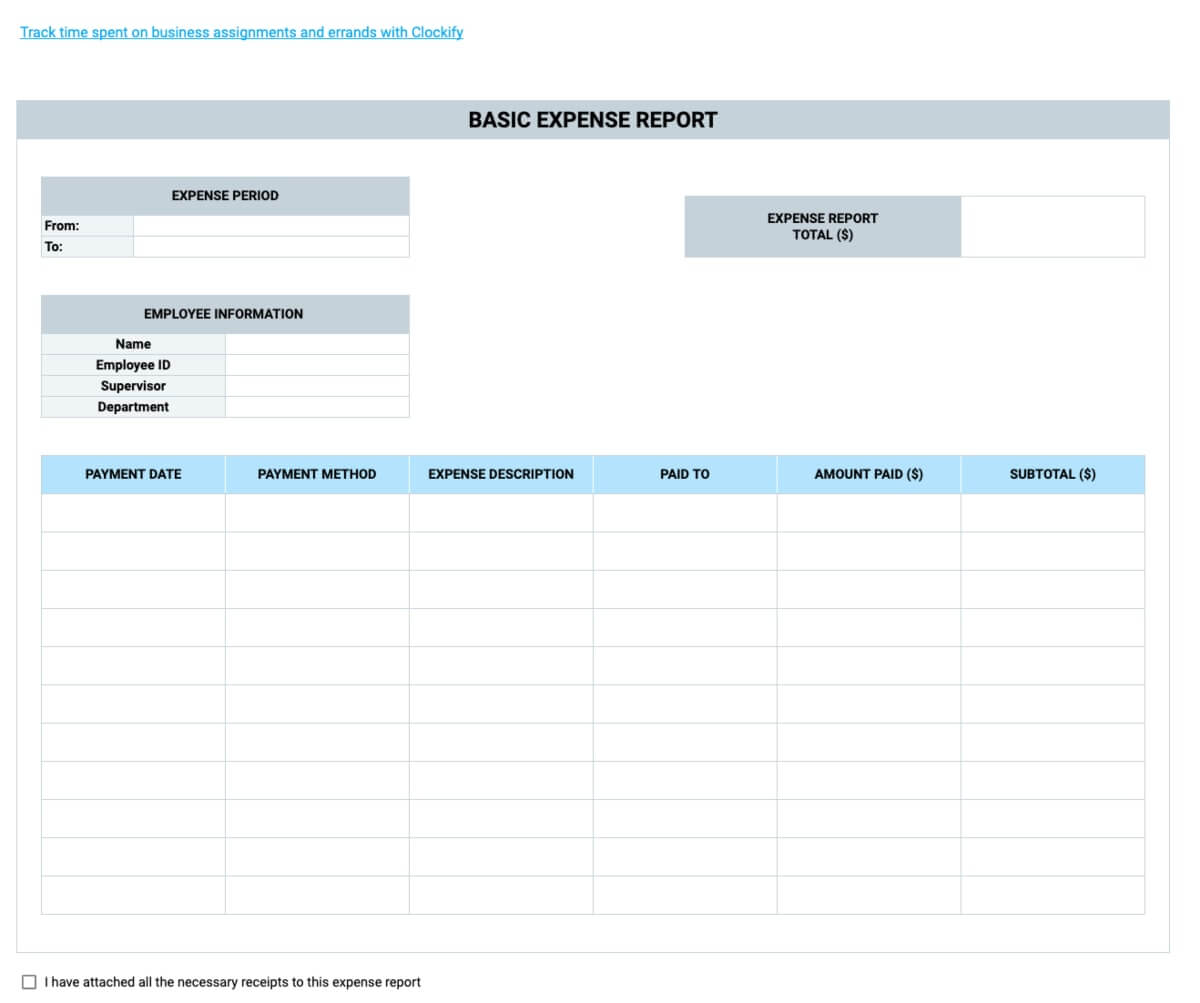

In case you need certain expenses to be covered ahead of their schedule, then the Expense Report with Advance Reimbursement could be just the solution to ensure everything goes as planned.

What is the Expense Report with Advance Reimbursement Template?

The Expense Report with Advance Reimbursement template assumes you got part of the sum you're expected to spend on the business activity in advance.

How to use the Expense Report with Advance Reimbursement Template?

In this report template, first, organize your expenses by:

Once you enter the amounts you’ll pay for each item, you'll get your expenses calculated by the total.

As soon as you enter the amount you got in advance for the itemized expenses, you'll get the clean total reimbursement for the whole expense period covered.

The Expense Report with Advance Reimbursement is best for:

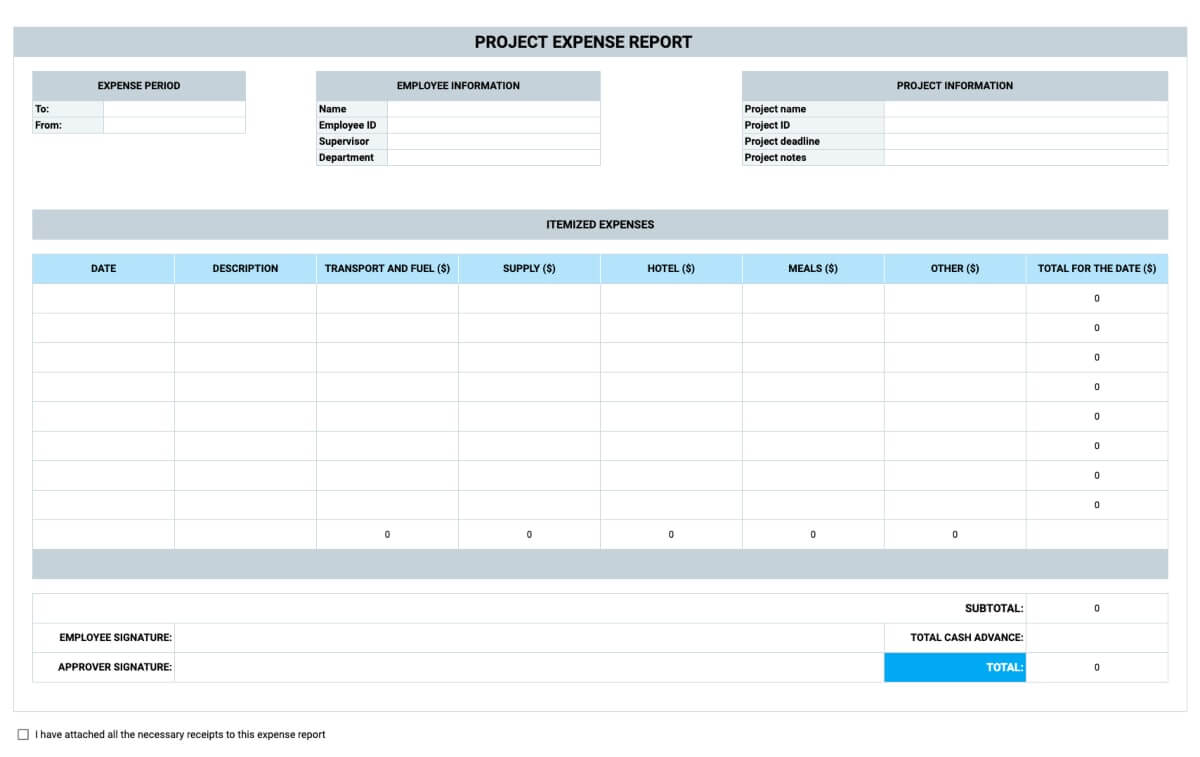

If you’re working on a project that requires you to take note of all the expenses incurred while completing your project tasks, then the Project Expense Report Template could come in handy.

What is the Project Expense Report Template?

The Project Expense Report Template lets you organize all your project-related expenses by date and description.

How to use the Project Expense Report Template?

You can start by specifying your task expenses.

Also, if your project requires travel, you can also add more detail regarding your transport, hotel, and meal-related expenses.

Once you've entered this data, you'll get your totals for each date calculated automatically, as well as the total for the entire expense period covered in this report. You'll also get the totals for each category (transport, hotel, meals) calculated automatically.

The Project Expense Report Template is best for:

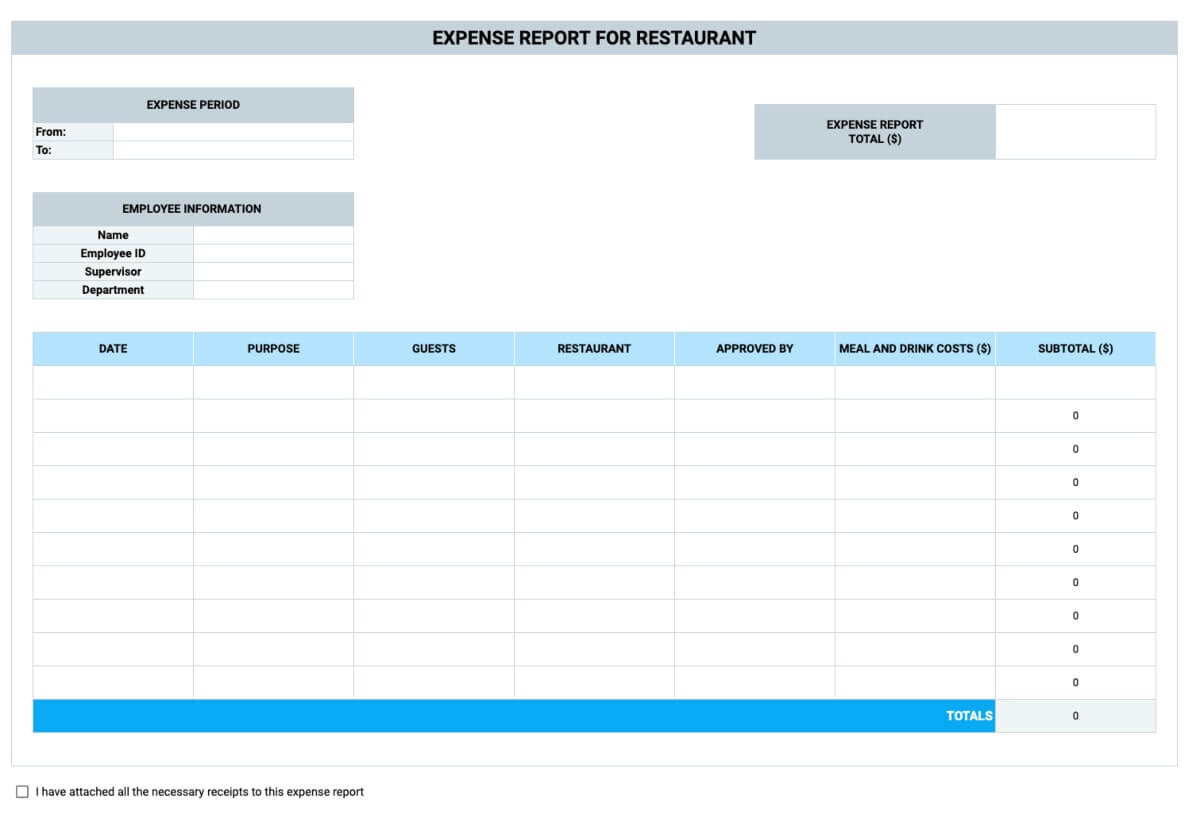

If your job requires you to frequently attend business lunches, then you need an expense report to keep track of all the costs, and that’s exactly what the Expense Report for Restaurant Template is for.

What is the Expense Report for Restaurant Template?

The Expense Report for Restaurant Template lets you track and record the expenses you make during business meals with business partners, clients, and potential employees you're looking to recruit to your company.

How to use the Expense Report for Restaurant Template?

Once you've added all the data regarding the purpose of your restaurant visit and the costs, you'll have your meal and drink costs calculated by date, subtotal, and total.

The Expense Report for Restaurant Template is best for:

In case you’re looking for ready-made, easy-to-edit Expense Report Templates that can help you keep an eye on your expenses on a weekly or monthly basis, then the Timed Expense Report Templates could be perfect for you.

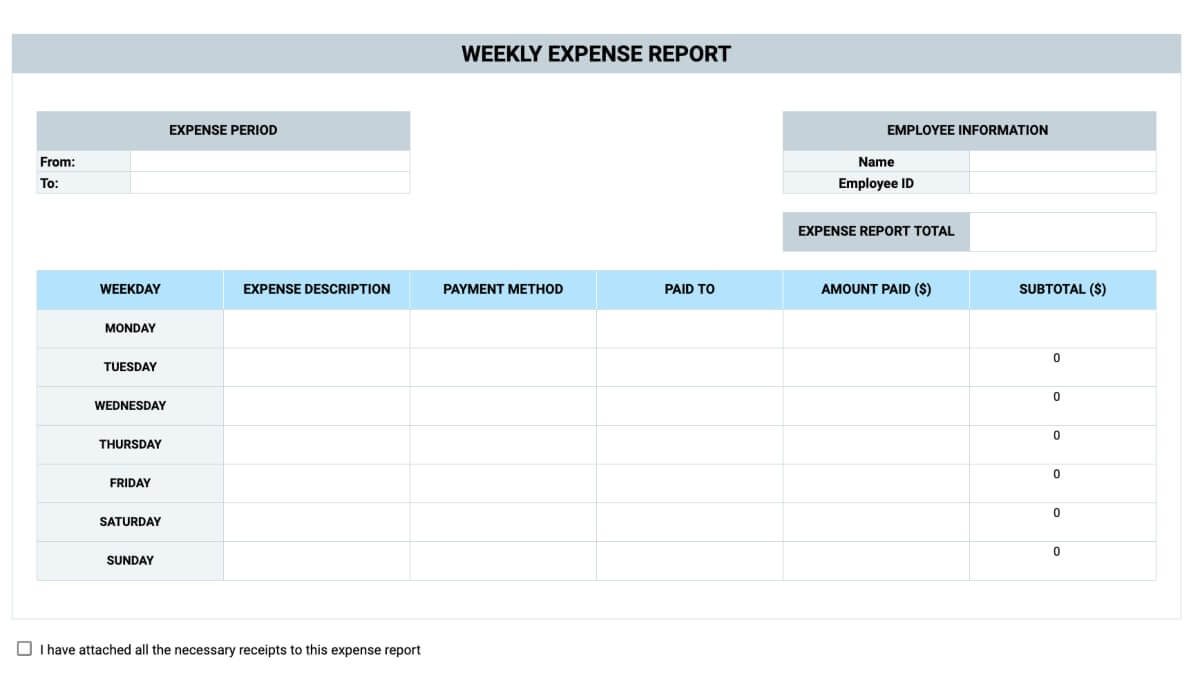

If you need to keep track of your expenses week in and week out, then the Weekly Expense Report Template could make your job quite easier.

What is the Weekly Expense Report Template?

The Weekly Expense Report Template lets you list your expenses, related payment methods, and the people the amounts were paid to on a weekly basis.

How to use the Weekly Expense Report Template?

Once you enter the expense description, payment method, the amount paid, and the person to whom the amount was paid, your subtotals for each day get calculated automatically.

You'll also get your total for the entire expense period calculated automatically.

The Weekly Expense Report Template is best for:

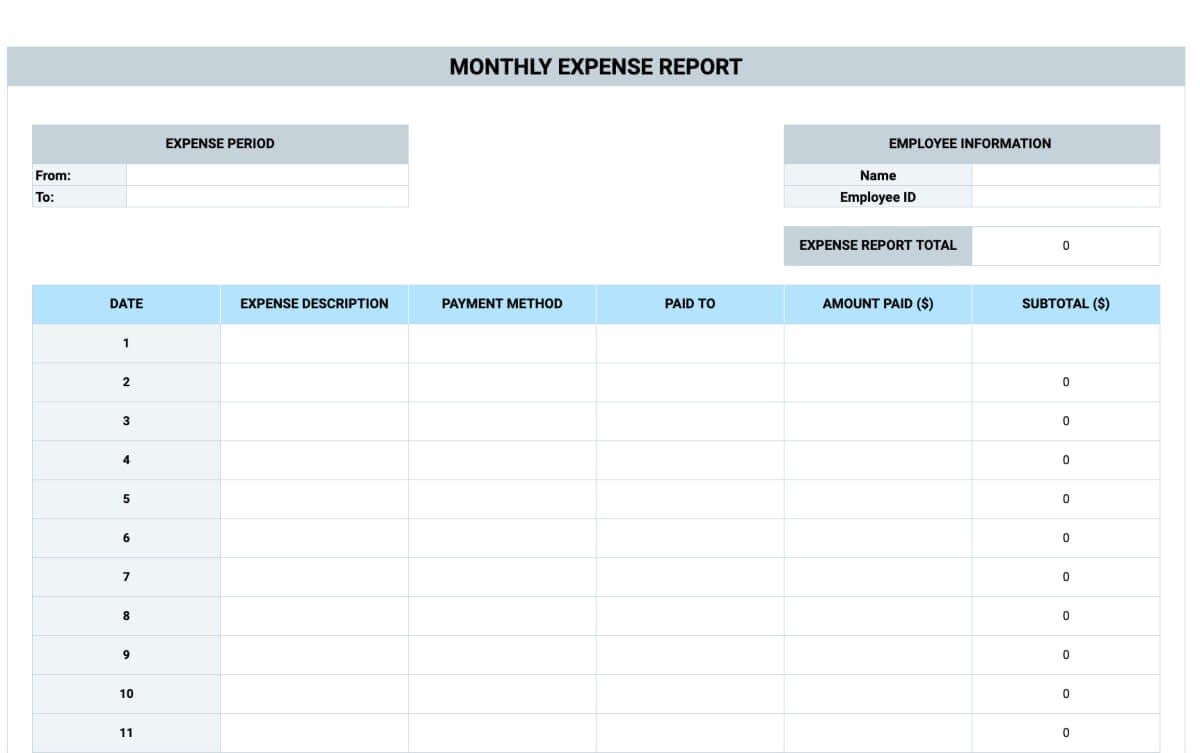

Sometimes you’ll need to keep an eye on your expenses on a monthly basis, so to automate this process as much as possible, you can use the Monthly Expense Report Template. Such templates are specifically designed to monitor your monthly expenditures hassle-free.

What is the Monthly Expense Report Template?

The Monthly Expense Report Template lets you list your expenses, related payment methods, and the people the amounts were paid to on a monthly basis.

How to use the Monthly Expense Report Template?

Once you enter the data regarding your expense description, payment method, and the person to whom the amount was paid, your subtotals for each date get calculated automatically.

You'll also get your total for the entire expense period calculated automatically.

The Monthly Expense Report Template is best for:

Whenever you need to travel for business purposes, you’ll need a way to keep a record of your expenses, and this is where Travel Expense Report Templates come into the picture.

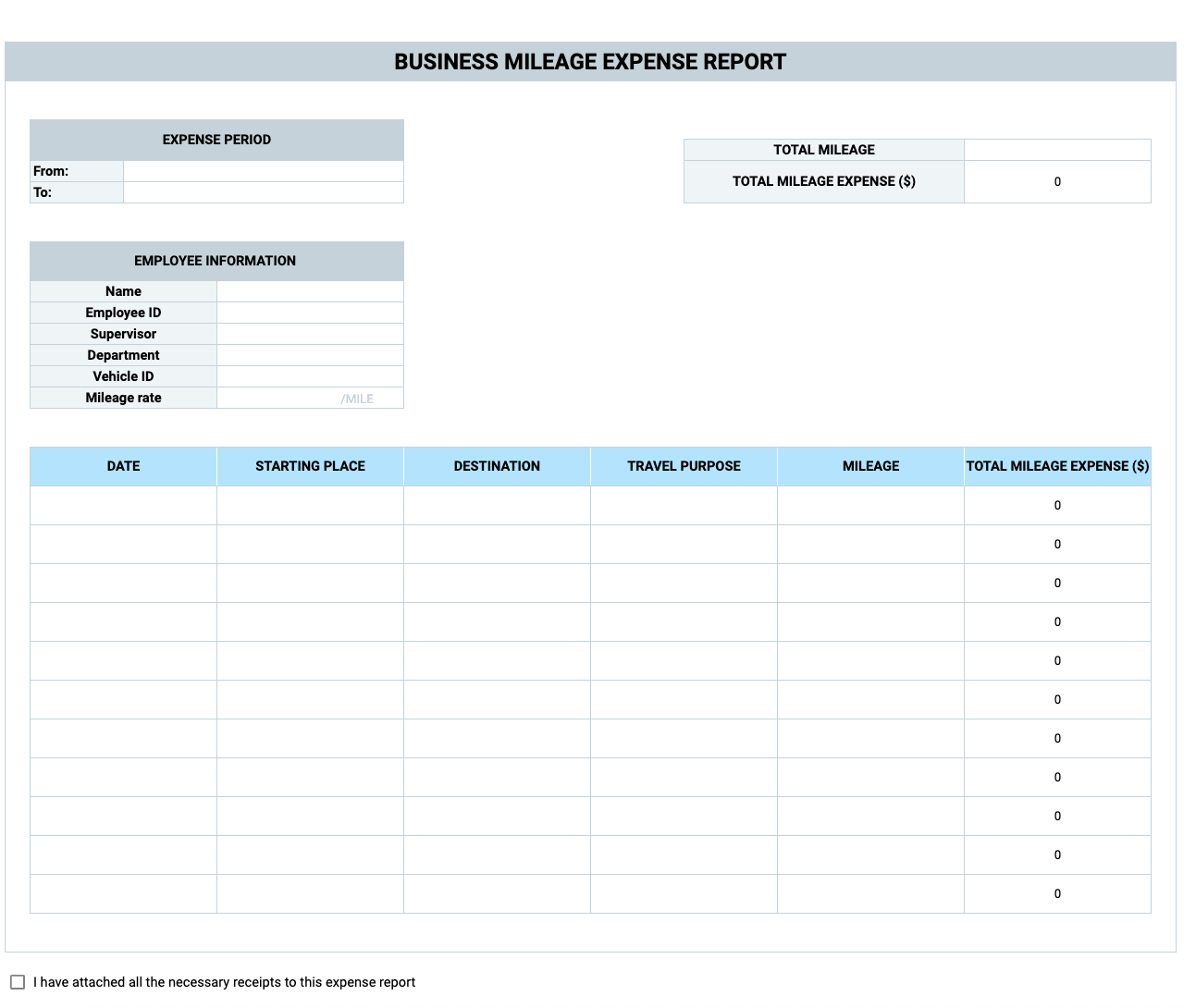

If you frequently need to use your company’s vehicle, and you’re looking for a simple Expense template to keep up with all the costs — then the Business Mileage Expense Template can help you automate this process.

What is the Business Mileage Expense Report Template?

This Business Mileage Expense Report lets you:

How to use the Business Mileage Expense Report Template?

After you've added all the data, including the date, purpose, and mileage, you'll get your total mileage expense for the said date calculated automatically.

You'll also get the total mileage expense for the expense period covered by this report calculated automatically.

The Business Mileage Expense Report Template is best for:

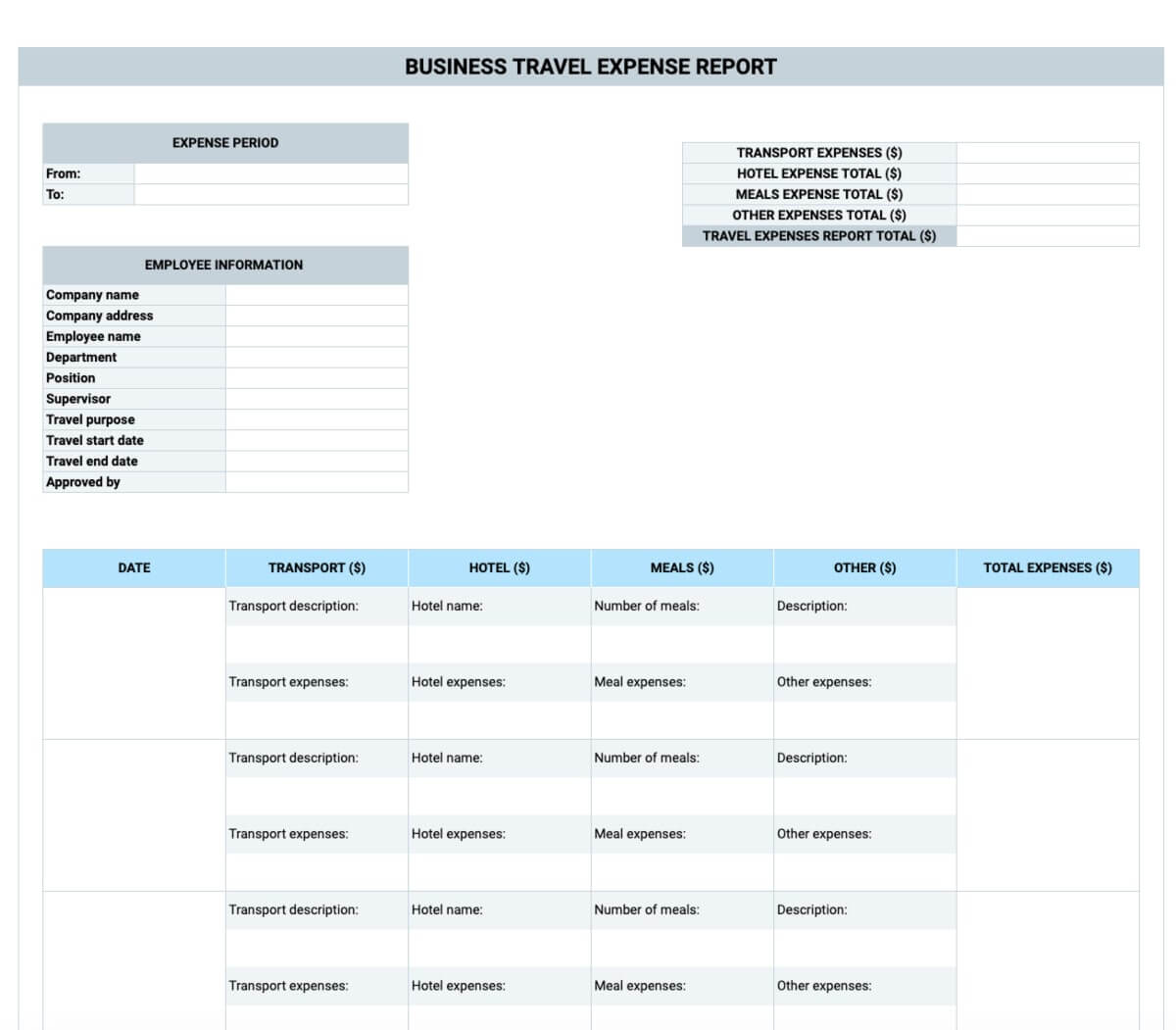

In case you frequently need to travel for business purposes, then the Business Travel Expense Report Template could come in handy. Such templates can save you from calculating all your costs manually.

What is the Business Travel Expense Report Template?

The Business Travel Expense Report lets you track expenses for your business travels.

How to use the Business Travel Expense Report Template?

You can add your transport, hotel, meal and other travel-related expenses and have your total travel expenses for that date calculated automatically.

Once you've added this data, you'll also have your total transport, hotel, meal and other travel-related expenses calculated automatically for the entire business trip.

The Business Travel Expense Report Template is best for:

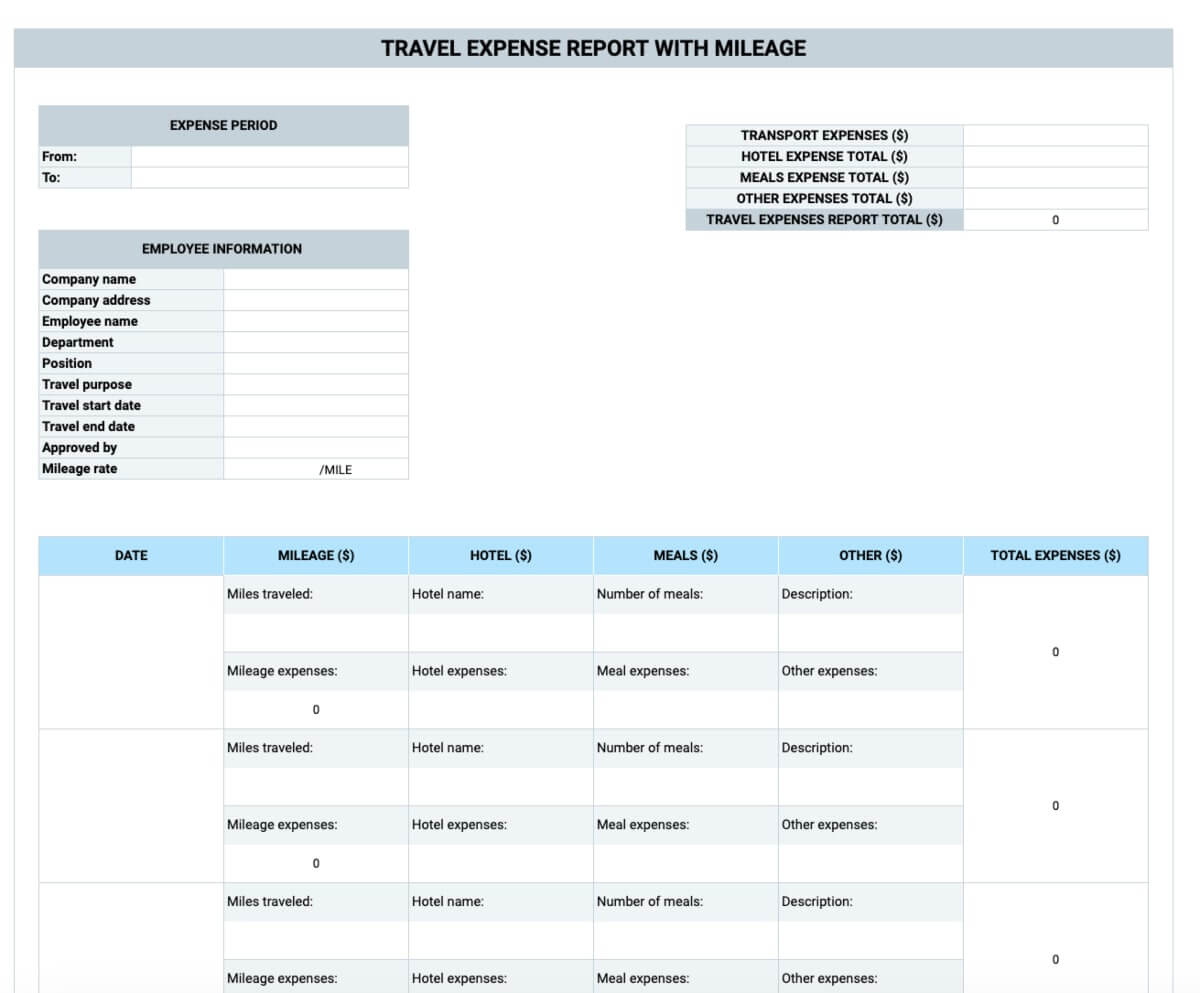

If your job requires you to travel frequently for business purposes, but you usually need to use your own vehicle — then the Travel Expense with Mileage Report Template can help you quickly calculate your travel expenses.

What is the Travel Expense with Mileage Report Template ?

Unlike a regular Business Travel Expense Report, the Expense Report for Travel with Mileage includes a section for mileage alongside the sections for the hotel, meals, and other travel-related expenses.

How to use the Travel Expense with Mileage Report Template?

After you've added all the data regarding your travel expenses, you'll get your total expenses for the specific date calculated automatically.

You'll also get your total mileage, hotel, meal and other travel-related expenses calculated automatically for the entire business trip.

The Travel Expense with Mileage Report Template is best for:

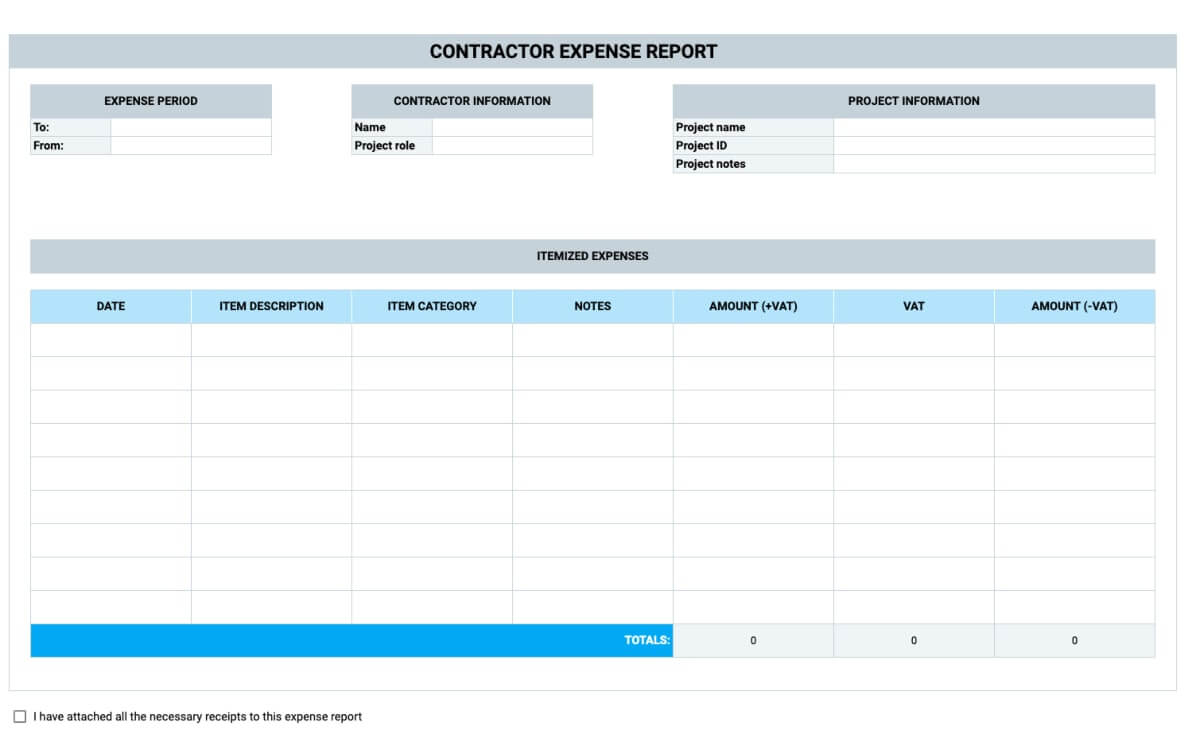

If you’re a freelancer looking for a simple template that does your expense calculations for you, then this Freelancer Expense Report Template can help you stay on top of your expenses.

In case you’re looking for a simple form to help you keep track of your freelance expenses, then the Contractor Expense Report Template could come in handy.

What is the Contractor Expense Report Template?

A Contractor Expense Report Template lets you itemize and categorize your work-related freelance expenses.

How to use the Contractor Expense Report Template?

After you've added all the data regarding your expenses , you'll get the amounts the company that hired you owes you (both with and without VAT expenses) calculated automatically.

The Contractor Expense Report Template is best for:

If none of the above-mentioned reports fall under the category that you were looking for — check out the Miscellaneous Expense Report Templates to find the right template for you.

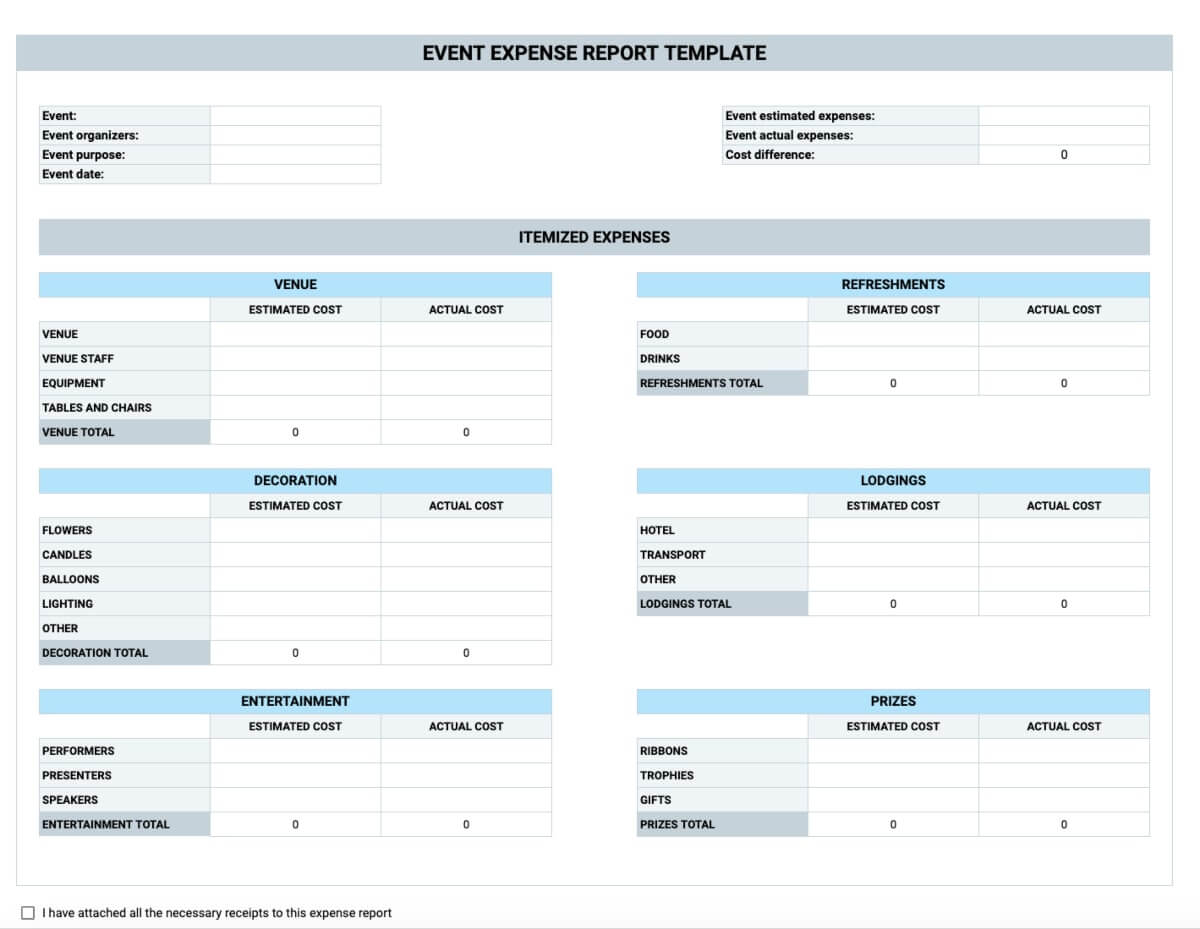

If you’re in search of a simple-to-use template to help you keep up with all your event-related costs, then the Event Expense Report Template could be exactly what you were looking for.

What is the Event Expense Report Template?

The Event Expense Report Template lets you record all your business event-related expenses.

How to use the Event Expense Report Template?

You can add both estimated and actual expenses, such as:

Once you've added this data, your estimated and actual expenses for each section will be automatically calculated.

Your estimated and actual expenses for the entire event will also be calculated automatically, as well as the overall disparity between the two.

The Event Expense Report Template is best for:

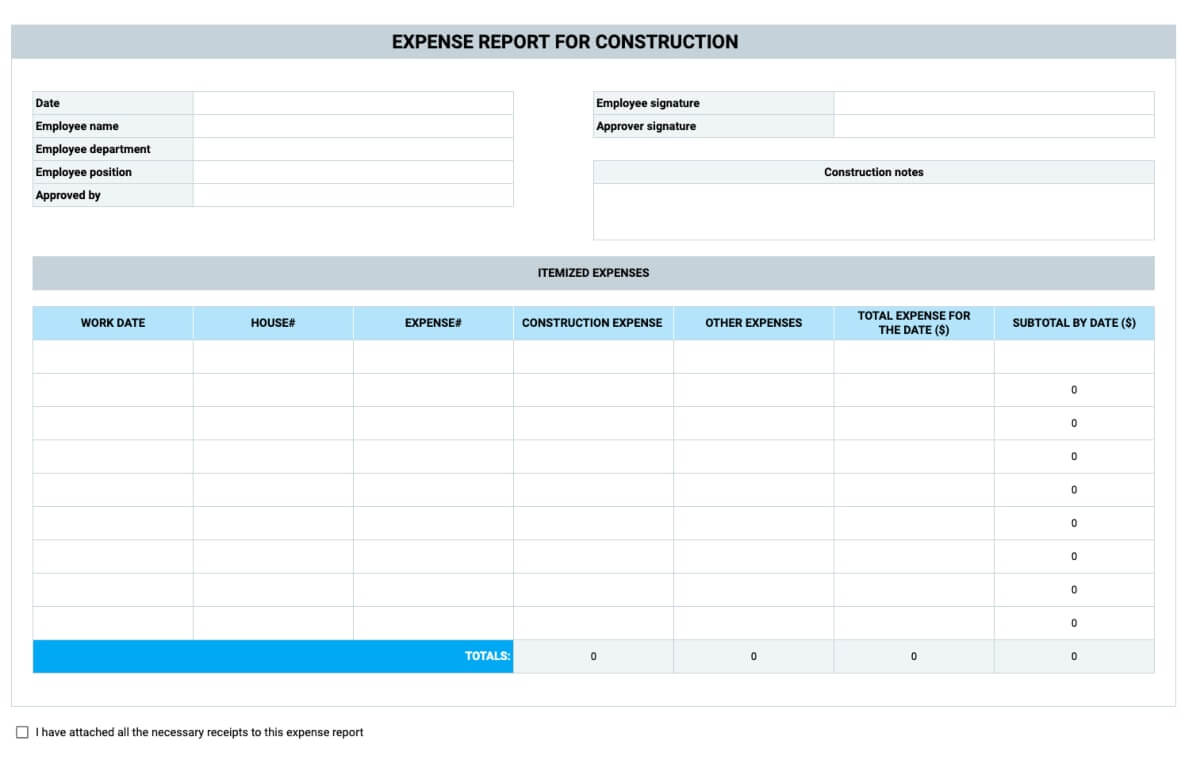

If you frequently need to cover construction-related expenses and you need an easy way to stay on top of them — then the Expense Report for Construction Template has got you covered.

What is the Expense Report for Construction Template?

The Expense Report for Construction lets you track and record your construction-related expenses.

Simply, add your work date and specify the house identification number, the expense identification number, as well as the construction and construction-related expenses.

Once you've added this data, you'll get the total expense for the date, as well as the subtotal by date calculated automatically.

You'll also get your total for the construction and construction-related expenses calculated automatically as well as the total for the entire time period covered by this expense report.

The Expense Report for Construction Template is best for:

Not only do expense reports underline some of the issues people might have with them, but they also say a lot about the employees who fill them out.

The research included in the Wall Street Journal helps distinguish among five different types of employees based on how they approach the expense reporting process:

So what type are you?

The Sidestepper is often reluctant to report their expenses to the employer, no matter how big or small.

Let's call the Sidestepper Alice.

Alice finds the data she needs to add to her expense report confusing.

She believes the process takes too much of her time.

She also fears that her employer will start questioning the items in her Report if some of the items turn out pricer than expected.

So, Alice the Sidestepper often decides that it's easier not to report the expenses and often pays for them from her own pocket.

Take your time to understand your company’s expense policy — ask for further clarification from the company's bookkeeper or your colleagues when needed.

Treat your expense report like a work task, and define the time you'll spend on it on a daily or weekly basis.

Then, track the time you spend filling out each Report to make sure you stay within your predefined time limit.

Where applicable, use the reports note and description sections to clarify why certain items turned out costlier than expected.

The Martyr often avoids filing for expense reimbursement. But, unlike the Sidestepper, who avoids the process because they are too "confusing" or "stress-inducing," the Martyr does so because they feel personally "close" to the company and its cause. Therefore, Martyrs treat these business expenses like their own.

Let's call the Martyr Peter.

Peter the Martyr rarely asks for reimbursements and covers most of his job-related expenses from his own pocket.

The feeling of closeness you have to your company is admirable, but you should still file reimbursement requests for your business-related expenses. Asking for reimbursement is necessary if you want to stay compliant with your company's expense policy.

Unlike the Sidestepper and the Martyr, the Payback Artist is overzealous in asking for expense reimbursement.

Let's call the Payback Artist Matt.

Matt asks for reimbursement for every dollar he spends — because he wants to pay the company back for something he believes is an injustice toward him.

This "payback" may be tied to his salary being smaller than he thinks he deserves.

Or, it may be tied to Matt thinking his superiors have salaries much bigger than he thinks they deserve.

It may also be tied to some rejected expense reimbursement he experienced in the past — and now he wants to settle that expense indirectly, through other requests.

So, Matt, the Payback Artist, decides to file for as many expense reimbursements as he believes are enough before he and the company are square.

If you unjustly didn't get approval for a past reimbursement request, don't turn to payback. Sure, it might make you feel better, but it does nothing to stop the problem from happening in the future. Instead, turn the matter over to a higher entity in your company.

If you think your salary is unfair, don't up your expense report to make matters even — try asking for a salary raise, coupled with concrete proof of why you deserve one. You might be pleasantly surprised by the outcome of it.

The Rookie is also overzealous in making sure the expenses listed are in order — because they generally don't know precisely when and how to ask for a reimbursement.

Let's call the Rookie Christina.

Christina just got her first job at a prestigious company, and she's still unfamiliar with how the expense policy of her new company works.

It's hard for her to decide what to file a reimbursement claim for. When she travels for business, she books cheap flights and stays in economical hotels because she believes that's the right thing to do.

Let's now look at another Rookie — David.

David also just got a job at a prestigious company. However, unlike Christina, David always asks for the most expensive services when on a business trip, because he believes that's what the concept of expense reimbursement is for.

So, Christina and David are both Rookies, but in different ways — she is afraid of overstepping an imaginary boundary, and he treats the reimbursement policy like an invitation to spend money freely.

Study your company's expense policy, and underline the points you don't understand. You can then ask the company's bookkeeper to clarify these points — or you can ask your colleagues about the general amounts they spend on the items you tend to overspend or underspend on.

The Grifter generally plays loose with the "business" part of the phrase "business expense policy" — and tends to also ask for reimbursement for more personal expenses.

Let's call the Grifter Annabelle.

Annabelle likes to expand the expense policy beyond typical business expenses — to items that range from babysitting services to new jewelry.

But, she is a high-achiever at her company, so the employer generally turns a blind eye to such behavior.

So, Anabelle the Grifter is similar to the Rookies David and Christina — the difference is that she knows her expense policy well, yet she often decides to bypass it.

You might want to be more careful about adding questionable items to your expense reports — just because you got away with it three times, it doesn't mean you won't get into trouble the 4th time. So, try to keep your expense reimbursement requests within a reasonable amount and purpose.

Although expense report templates are a nifty way to keep an eye on your expenses, as is the case with all ready-made templates, they might not always be a one-size-fits-all solution.

Sometimes you might need to include more detail than you can fit in a premade template, so you’ll find it easier to go for another option that can keep all your costs in one place, and this is where an expense tracker can turn out to be useful.

But, what is an expense tracker?

![]()

Well, its purpose is to help speed up the process of expense reporting even further.

This type of software helps you calculate and keep the costs of your business operations and tasks in one place. You can quickly generate reports from here showing how much you need to be reimbursed for a business-related activity, be it business travel, a client lunch, or a promotional event.

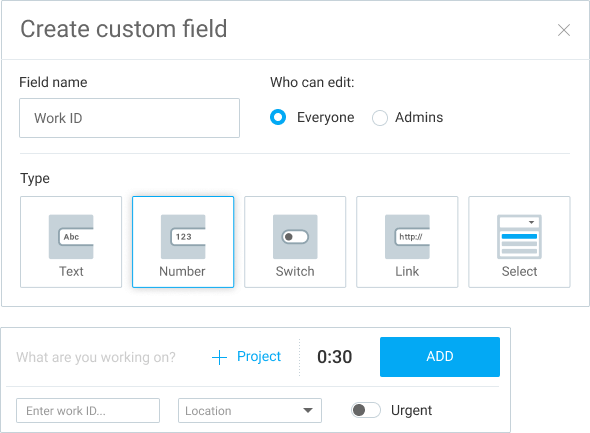

Despite it not being a traditional expense report software, you can use Clockify to help facilitate the process of expense reporting even further — alongside the listed Expense Report Templates.

In its essence, Clockify is free time tracking software that lets you easily track the time you spend on tasks and projects before automatically calculating how much you need to be paid for your time. But, it can also help you speed up your expense reporting — if you use Clockify's custom fields.

The custom fields feature lets you add a special custom field to your time entries (either for all projects or only for some projects) where you'll be able to:

Later on, you'll be able to export a Detailed Report of your time results and view your time entries, as well as their specific expenses, mileage, and receipts listed in a CSV or Excel table.

In addition to helping you record your expenses, Clockify can also help you record and see whether the time you spend on the said business tasks is really worth it.

This knowledge will really help put the time you spend on certain business tasks in perspective. Perhaps you'll find that the 10 business lunches with clients you arrange per month are literally not worth your time.

Here's how you can draw these conclusions with Clockify:

When you want to take a client out for a business lunch, treat it like a task you'll add to the appropriate project in your project list at Clockify.

You can track time on this project-related task by starting a timer and tracking time while you're at the business lunch.

Or, you can add the time you've spent on the said task manually after you've parted ways with your client.

Either way, you'll get your earnings for the time you invested in this business task calculated automatically.

Perhaps you'll find that you've just spent $90 on a 3-hour business lunch with a client who decided to cut down significantly on the billable time your company is expected to put in for the project in the future.

In contrast, if your hourly rate for this project is $50, you've not only overspent for lunch, but you've also just lost 3 hours you could have allocated to more actionable tasks ($90 spent, in contrast with the $150 you could have earned by working on something else).