Military Money Manual has partnered with CardRatings for our coverage of credit card products and may receive a commission from card issuers. Some or all of the cards that appear on this site are from advertisers and may impact how and where card products appear on the site. This site does not include all card companies or all available card offers. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

As a military veteran, I've enjoyed over a decade of American Express membership. When active duty troops ask me, “What is the best credit card for military servicemembers?” it's easy to point to The Platinum Card ® from American Express.

Learn how to apply for the Amex Platinum card on our partner's secure site

The Amex Platinum military benefits make this card my top recommended card for active duty, Guard, Reservists, and military spouses. Amex offers special protections on annual fees to you and your spouse.

You can learn why I recommend American Express cards and very important details about American Express special protections for you and your spouse in this article.

If you want me to email you the details on American Express Platinum military benefits, drop in your email below. I'll just send you one email only. No spam, no newsletter. Just one email with all the details.

If you want to get the full free military credit cards course, you can sign up at the Ultimate Military Credit Cards Course. Over 14,000 graduates of the course prove that it works.

I served over 12 years on active duty in the Air Force flying jets all over the world. Carrying my Amex Platinum was a no-brainer thanks to the benefits and support American Express gives to all US military servicemembers.

I recorded a podcast episode on the Amex Platinum military benefits with my friend and co-host Jamie. You can listen to it below, on Spotify, or on Apple Podcasts.

Story time: I went TDY (temporary duty) to France in 2013 to carry French troops down to Mali to fight Boko Haram. One of the C-17 loadmasters I was travelling with, a Tech Sergeant, mentioned that he had the American Express Platinum card that comes with a $695 annual fee.

“How is that possible?” I asked.

“Simple,” he responded, “I get special Amex military protections on the card.”

To learn more about what these protections include, checkout my in depth American Express benefits page.

My eyes were opened! It seemed like all the secrets of the universe we're revealed. This E-6 had access to great airport lounges in Amsterdam while we were travelling commercial on TDY.

While I paid $15 for an airport sandwich, he was enjoying free food and drink courtesy of his American Express card in the airport lounge.

My loadmaster friend also told me about the other Amex Platinum benefits, such as airline fee reimbursement and the welcome bonus offer.

I thought the rewards program sounded good and the benefits were great, but I couldn't justify that insanely high annual fee. $695 a year was WAY too much money for a young Air Force lieutenant!

Amex Platinum Military SpousesThe Amex Platinum card is also my #1 recommended card for military spouses. Again, learn why I recommend this card for military spouses in the American Express military article.

I've been an American Express Card Member for over 15 years, since 2007. Amex offers legendary support for the military with amazing customer service and credit and charge card products. My wife and I opened over 15 American Express cards while I was active duty.

My military spouse wife had several Amex cards when I was active duty and kept most of them after I separated from active duty.

We enjoyed all the benefits of Card Membership, including lounge access, airline fee credits, Uber credits, and much more. This is a great deal for military servicemembers and their spouses!

Another story time: So there I was… On a deployment exercise, sitting at a bar on a military base near Gulfport, Louisiana. Behind the bar was a wooden, multi-tiered stand to keep cards of open tabs.

Of the 2 dozen cards behind the bar, over half were Amex Platinum cards. It was comical!

You could see all the Amex Platinum cards shining in their metallic glory in this low-rent bar in backwater Louisiana.

But it makes total sense – Why wouldn't a military member apply for the Amex Platinum card when it has such a substantial welcome bonus offer and excellent annual benefits?

The Amex Platinum card comes with dozens of benefits, some that recur every year and some that you can only earn with minimum spend or by enrolling for the offer on americanexpress.com. Let's review them here:

The Amex Platinum card offers a 80,000 Amex Membership Reward (MR) point welcome bonus when you spend $8,000 in the first 6 months of card membership. That's only $1,333 of spending per month required.

80,000 points can be cashed out through the American Express Platinum Card ® for Schwab card at 1.1 cents per point, making 80,000 Amex worth $880 cash.

You can also redeem MR points for Amazon credit, but only at .7 cents per point, making 80k points worth $560.

However, if you really want to make your 80,000 Amex points go far, you should transfer them to a travel partner, like an airline or hotel. You can earn much more than 1-2 cents per point.

Aer Lingus, AeroMexico, Air Canada, Alitalia, All Nipon Airways (ANA), Cathay Pacific (Asia Miles), Avianca, British Airways, Delta, El Al, Emirates, Etihad, Flying Blue (Air France / KLM), Iberia, Hawaiian Airlines, JetBlue, Qantas, Singapore Airlines, Virgin Atlantic, Choice Hotels, Hilton Honors, Marriott Bonvoy

Amex Travel Partners

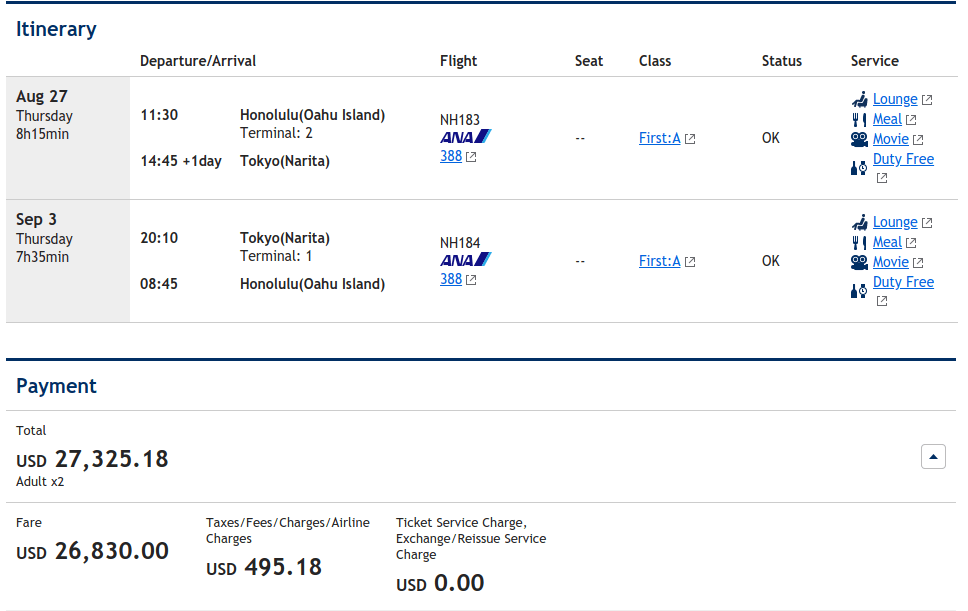

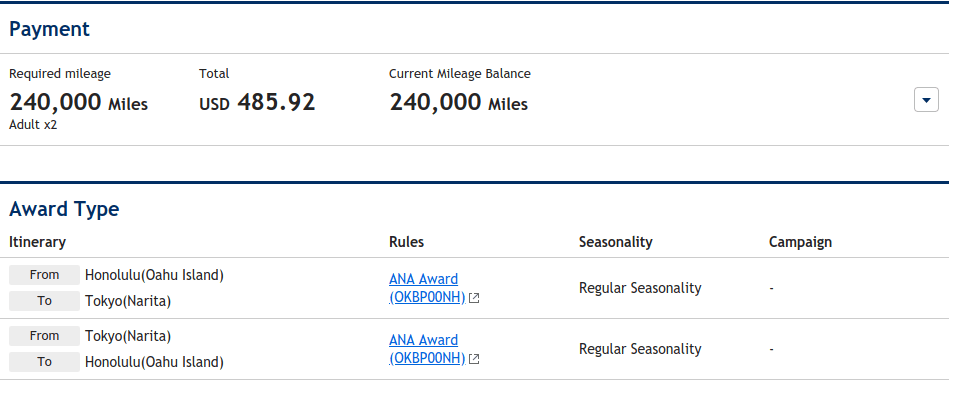

As an example, I recently cashed in 240,000 Amex MR points for $27,000 first class flight from Hawaii to Tokyo, Japan. That's 11 cents per point! 11 cents per point means 80,000 Amex MR points would be worth $8,800!

$27,000 ANA First class tickets…

ANA booked with AMEX points" width="965" height="393" />

ANA booked with AMEX points" width="965" height="393" />

…or 240,000 AMEX MR points and $485 cash!

Even at a conservative 2 cents per point, the 80,000 Amex Plat welcome bonus is worth $1600!

The annual fee on the Amex Platinum is usually $695 per year. However, military servicemembers and spouses qualify for special Amex military protections, explained in detail in my American Express military benefits article.

Make sure you read that article before applying for an Amex Platinum card, as you may qualify for special military protections on your card!

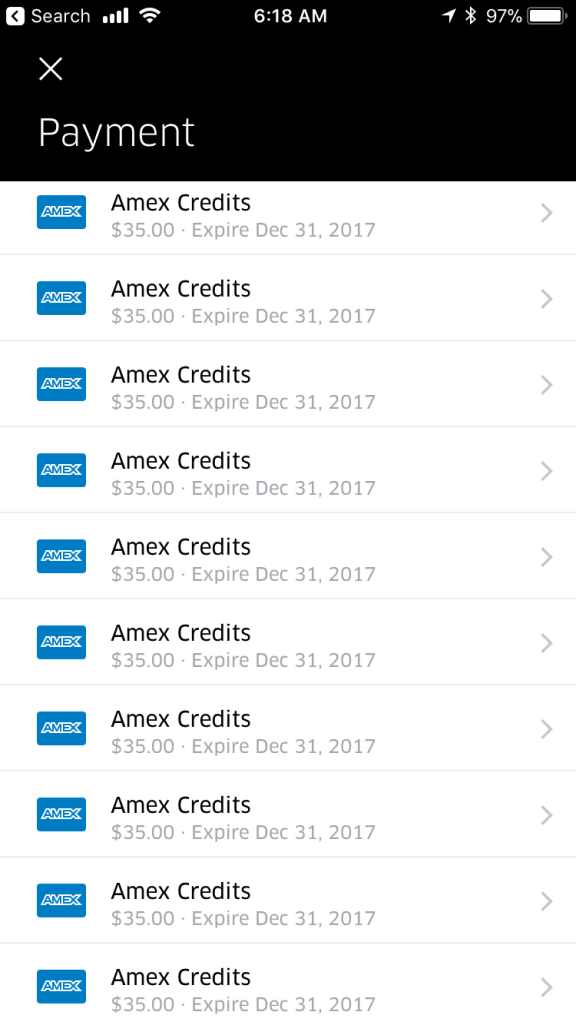

Every month, like clockwork, I get a $15 credit in my Uber account, just for keeping my no annual fee Amex Platinum card around.

If you have more than one Platinum card or your spouse has a Platinum card, you can stack the credits as well. In December American Express Platinum card hands out $35 in Uber credit.

When I lived in the United Arab Emirates for 2 years and could not use the credit, I sent UberEats to family and friends back home. Don't let those credits go to waste! The credits do not carry over month to month.

The Amex Platinum card come with up to $200 per year in hotel credits. You must book a prepaid hotel in the Amex Fine Hotels & Resorts or The Hotel Collection through the AmexTravel.com portal. Amex Fine Hotels & Resorts can be a one night stay. The Hotel Collection requires a two night minimum stay. You will receive the credit on your statement in a few days after making the purchase.

You can earn up to $240 per year in digital entertainment credits. The credit paid is paid as a $20 monthly statement credit on eligible subscriptions or purchases on any of these services:

I use mine for Hulu and The New York Times crossword.

You pick an airline of your choice every year on the American Express website. You can spend $200 on incidentals or fees on that airline and get the reimbursement posted to your credit card statement.

Since all military personnel already have TSA Pre-Check with their DOD ID numbers (the number on the back of your CAC), it makes sense to apply for the Global Entry program. With the Platinum card, your $100 sign up fee is reimbursed.

Global Entry gives you fast track access to the US when returning from overseas. This can be really nice when coming back to the US from OCONUS. The last thing you want after an economy class flight is to wait in a long line for Customs and Immigration.

The Centurion Lounges offered by American Express have some of the best food and drink available in lounges in the US. You can get into all of them for free with your Platinum card.

The Platinum Card ® from American Express also gives you complimentary membership in the Priority Pass program, giving you access to an additional 1200+ airport lounges around the world.

When you're travelling internationally or domestically, it's really nice to not have to worry about food, where you're going to charge your phone, or if the bathrooms are going to be nice. Lounge access takes you far from the madding crowds and gives you a little bit of peace in your travels.

The hotel elite status you get automatically just for having a Platinum card make this card a no-brainer. As a military servicemember, chances are pretty good that you travel for work or fun. Here are my top recommended hotel credit cards for military.

There is almost always an Marriott or Hilton property near your TDY location or your vacation spot. Since SPG and Marriott just merged you should have no problem cashing in on this benefit.

You will earn extra points when you stay at these properties because of your status and you might get freebies like breakfast, room upgrades, or other perks.

To get even better Marriott and Hilton Elite status, check out the no annual fee Marriott credit cards for military and automatic Diamond status (the highest offered) on the Hilton credit cards for military.

The best luxury travel cards offer no foreign transaction fees. Most of the cards in my wallet have no foreign transaction fees. If you are stationed OCONUS or travel a lot OCONUS, you need to make sure you always have a no foreign transaction fee card in your wallet.

It just doesn't make sense to pay foreign transaction fees, especially when you get an great travel rewards card like the Amex Platinum Card with a waived annual fee. Do the math and don't pay extra when you do not have to!

Enroll via your Amex Platinum card account and enjoy up to a $50 credit between January and June and then again July to December. I never used to shop at Saks Fifth Avenue but now I do every year twice a year to maximize my credit!

I've gotten some really nice underwear, socks, and cashmere sweaters from Saks with my credit. You'll be surprised how much you use it! The Amex Platinum Saks credit only take a few days to post to your account.

American Express offers a unique opportunity to US servicemembers to earn a ton of Membership Rewards points, Marriott Bonvoy points, Hilton Honors points, and Delta Skymiles.

You could earn hundreds of thousands or even millions of points through regular spending, welcome bonuses, and referral bonuses with your Amex cards.

These travel and cash back Amex cards can open up business class and first class air travel opportunities and free hotel and resort stays that would cost you thousands if you paid cash.

After you learn how to apply for the Amex Platinum Card for military, sign up for my 100% free, 5 day course on how to maximize your military travel credit card benefits!

Usually the Platinum Card for American Express requires good to excellent credit. That means at least 700 points out of a maximum 850 FICO score. You can check your credit score for free with Credit Karma or Credit Sesame.

Is the Amex Platinum card metal?Yes, the Amex Platinum card is made out of metal and will even rust if left in water. The card makes a satisfying “thunk” sound when you throw it down. You'll want to pick up the bill for your friends just to drop it on the table!

Read the best credit cards for military article or see the list below.

*All information about American Express Hilton Honors Aspire Card has been collected independently by MilitaryMoneyManual.com

Only if you opened the cards while on active duty. Check out my what to do with credit cards when you retire from the military article.

Hello Spencer, Is it possible to just apply for Amex Platinum, even when I have Amex Platinum? My goal is not to upgrade from my gold/green, instead why not just apply directly for platinum. Same questions for other Amex credit card such as Hilton, can I just apply for new Hilton aspire when I have Hilton aspire already? Don’t want to wait for one year, and upgrade. I think I’m in pop up jail where I don’t get sign up bonus offers. Thank you

Yes, it is possible to do direct applications for any Amex card, even if you already hold one. You don’t have to wait a year to upgrade, you can just follow the Amex application guidelines (usually only 2 cards every 90 days) and directly apply. You usually won’t receive welcome bonuses if you already have the card.

Can mil spouses apply for their own card, as in not an authorized user but their own separate account, and have the fees waived?

Yes. More details on military spouse Amex fee waivers here.So I just upgraded my amex green to a platinum even my wife and I each have 2 amex platinums already? Does Amex apply an annual fee to the service member on any extra vanilla platinum cards beyond the first

If you are listed as eligible in the SCRA or MLA database, you pay no annual fees on any of your Amex cards. No matter how many Amex Platinums you have. I have 7.

Spencer, I’m currently overseas and most places don’t take the American Express in Europe (My experience). Do you recommend any cards that I should apply for until I make it back to the USA in the next few years?

Chase Sapphire Reserve $550 annual fee waived, no foreign transaction fees (great for Europe), Visa so widely accepted globally, $300 annual travel credit, and more

Thank you for the tip and what you do for fellow service members!Happy New Year Spencer, quick question for you. I have an AMEX platinum/gold and CSR (all active for less than 1 year). My wife is an authorized user on all three. Should she get a platinum and upgrade her gold? Should I get one more Chase card to finish off my 5/24, then go back to AMEX and work on cobranded cards? How do you suggest we proceed with our credit card strategy and do authorized user slots take up 5/24? In order to reach the minimum spending on these cards would you agree it makes sense to do only one new card at a time between my wife and I? Thank you for tall the great advice!

Yes, she should get a Platinum and if she wants a second Platinum, she should upgrade her Amex Gold card and then apply for another Amex Gold card to keep 4x Membership Reward points going on US supermarkets and restaurants. I would get one more Chase card and then go back to Amex while you are over 5/24. Authorized user slots shouldn’t take up 5/24 spots. I usually only did 1 card at a time between me and my wife to ensure we could hit the spending minimums to earn welcome bonuses.

Hey Spencer,

Do you have an upgrade guide to getting more and more platinum cards? I currently have the regular Amex Platinum Card, and I recently product changed a Gold Card -> Platinum and a Green Card -> Platinum. Thus, I currently have (3) Amex Platinum cards. Do you have a guide on which cards should I get next so I can do more product changes?

Schwab Amex Platinum next. Then just do direct applications for more Amex Platinums or open new Amex Green and Amex Gold accounts and upgrade them.

Hello Spencer!

I’ve been following your post and reading but I’m not too sure if I missed it somewhere. Amex allows up to 5 credit cards, excluding charge cards (Amex platinum, gold etc). I already have Amex Marriott brilliant, Hilton aspire, Amex platinum, Amex Charles Schwab, Amex gold, Amex green. My plan is to upgrade gold and green after 1 year to platinum.

My question is once I upgrade gold, can I apply for gold again?

My end goal is to have 4 Amex platinum, and one gold as charge cards. I’m still deciding which one to apply as credit cards. Based on your post, I’m definitely looking for Amex delta sky reserve even tho latest change, kinda turned down lots of people. I should also apply for Hilton surpass as well for upgrade purpose to Hilton aspire. I somehow don’t qualify for welcome offers when I apply for Hilton surpass and Amex delta reserve. I think my 5 credit cards will end up looking Marriott Brilliant, Hilton Aspire (3x), and delta reserve. Let me know if you have answer to question please! Thank you.

Yes, once you upgrade Amex Gold to Amex Platinum, you can re-apply and re-open an Amex Gold again. You probably will not be eligible to earn the welcome bonus again. I would recommend 3 Amex Hilton Aspire cards and 2 Amex Marriott Bonvoy Brilliants. That’s 5 free nights annually. The Amex Delta Reserve card is a bit useless unless you fly Delta at least once a year or you are Atlanta based. Or maybe if you have a big redemption coming up that you need Delta Skymiles for.

Thank you for reply! I delinked my gold card from my main Amex account so that I can upgrade to Amex platinum in a month. Only reason why I was considering delta reserve was to receive free annual companion certificate since I’m stationed in Hawaii for next few years. When you say 3 Hilton aspire credit cards, is that means I have to have 3 different username and password on Amex app?

I’m still waiting for welcome bonus to show up before I apply for Hilton surpass and Hilton honors. Or is it not possible since I received the bonus for Hilton aspire already?

You might be eligible for the Hilton welcome bonuses on the lower tier cards. Amex has been adding “family lanuage” recently, saying that if you have the higher tier card, you can’t get the welcome bonus on the lower tier cards. So for example, if you have the Hilton Aspire, you won’t be eligible for a welcome bonus on the lower tier Surpass. You could always open a Surpass and upgrade to another Aspire and skip the welcome bonus. The annual free night makes that worth it. The Amex application will warn you before they check your credit if you are eligible for the welcome bonus or not. No, you won’t need 3 separate Amex logins. You can have all 3 Hilton Aspire cards on your main account. You might need to move them to your “upgrade” account More on upgrading Hilton cards here. And creating multiple Amex logins here.

I understand now. Do you have any Amex business cards or chase business cards that you recommend? I have rental property so I might be good using sole proprietor option. I might not be able to spend a big amount for welcome offer but as long as annual fee is waived, I’m all for it. Should I apply for same, Hilton, platinum, delta?

Hello! I’m the wife of an active military duty member. I have had my amex platinum card since before we were married. I tried to request for the anuual fee to be waived, however they say that I am not eligible. Have you encountered this?

If you choose to close the account, I would open an Amex Gold card or Amex Green card to preserve your Amex membership rewards points and not lose them.

Also you could open a MLA annual fee waived Schwab Amex Platinum and preserve your points there.

Note that usually you are only eligible for an Amex welcome bonus every 7 years, so you will probably not be eligible for another Amex Platinum welcome bonus, but you can open a new Amex Platinum account and get your fees waived under MLA, which I think is worth it.

Can I get the welcome offer for the Charles Schwab PLAT if I obtained the vanilla PLAT (with its original welcome offer) back in 2018? I got the early notice of not being eligible for the welcome bonus and canx my application before doing the hard pull.

Yes you can. Sounds like you’re in the Amex jail. Wait a bit a reapply to earn the bonus. Thank you Spencer.Hi Spencer, I love your site and the wealth of knowledge you are passing along to fellow service members. Have you ever inquired about/received a retention offer on any Amex cards in which the annual fee was already waived?

Yes, I have received retention offers on my Amex cards even with the annual fee waived. I have never asked for one though. The fee waiver is enough of a retention offer for me. However, I do know some of my friends who have asked for an received retention offers. It just seems like an awkward request if you’re already getting the annual fees waived…

I am a military reservist who is assigned 45 days active duty tour per year while the rest is reserve. I got my platinum card 4 months earlier than my active duty tour begins. Will I either qualify for SCRA to bypass the annual fee, or will I be able to be reimbursed via MLA once my active duty begins? Thank you very much.

Because the account was established when you were not activated, you will need to apply for SCRA benefits with Amex. Check the SCRA database to confirm you are in it before applying for SCRA benefits. Usually you will be a few days after your orders start.

How about authorized users? Does the fee for the additional AU get waived too?Yes. But if you’re a military spouse or on active duty yourself, you should open your own card, not just add an additional user. The benefits are much greater having your own account, you can earn a welcome bonus, and you will get your annual fees waived if your correctly listed in the MLA database.

Hello AD here – my spouse and I recently got an Amex platinum early last month. Is it possible to apply for the Amex platinum again to have multiple ones or is it only possible through upgrading the gold and green cards?

I would recommend upgrading the Gold and Green before doing direct applications again. Also, give it a little bit of time between applications, maybe 3 months minimum.

Angel Cruz Thinking about applying.. currently active duty. Once i retire is the annual fee not waived anymore? Here’s what to do with your MLA annual fee waived credit cards when you retire.Sorry íf this was already asked, can my spouse and family benefit from my AMEX card, meaning can they use the airport lounges with me or does my spouse need to have her own AMEX card as well?

Do we have a data point on whether dependent children (minors) can be added as an authorized user under a servicemember’s account for a Platinum and have the fee waived? I assumed that since the servicemember’s account had already been reviewed and had fees waived that adding an AU would also be waived, but reps cannot confirm that for us.

Yes, military dependent children can be added and authorized user fees are waived when the primary user is military or military spouses. In fact any authorized user is annual fee waived when the primary user is in the MLA Database. You could add friends or family with no military connection. The reps never know anything about military benefits. It’s not worth calling.

Will an authorized user amex plat rewards stack with yours? For example if my has an amex plat on her own account, but i enroll her in one on my account as an AU, will her AU card have the benefits i.e another $15 uber credit?

No, there are no stacked benefits for authorized users. For instance, no Uber credit, airline fee credit, etc. That’s why I recommended that each spouse opens up their own account.

Adding on to this question…

Can the military member add 4 authorized users (not direct relatives) and still have the authorized fee waived for all 4? There are currently 2 authorized users on the account. If yes, can I do this online to add the two, or do I need to call on the phone? I could not get an answer from customer service.

Yes, as long as the primary account holder is in the MLA database, all authorized user fees are waived. Even if they are not direct relatives (not sure why this would be relevant). You can add online.

Hello Spencer,

I know your website is a financial website and my comment is more off topic but I was wondering if you can share some more in depth information/personal experience or explain some of the benefits of AMEX(or other cards), like specifically the Centurion & Priority Pass Lounge Access? I am new to credit cards and not very financial or credit card savvy so theres so much fine print to a lot of things that are foreign to me.

You share stories about your friend, and you and your wife using this benefit but Im thinking all of you individually have an AMEX card and no kids (I have 5 kids and a stay at home wife who doesn’t have a great chance of getting premium credit cards) so I was trying to understand the fine print on how many people can use these lounges and I see you can bring in 2 guests free and will be charged X amount of dollars after that for more. However it could also change depending on where you go and then I saw this:

>>>>Effective February 1, 2023, Platinum Card Members, Business Platinum Card Members and Additional Platinum Card Members on the account will be charged a $50 fee for each guest (or $30 for children aged 2 through 17, with proof of age). To receive Complimentary Guest Access at these locations after January 31, 2023, the total eligible purchases on the Platinum Account must equal or exceed $75,000 between January 1, 2022 and December 31, 2022 and in each calendar year thereafter. Guest access policies may vary internationally by location and are subject to change.>>Primary Cardmembers and Authorized Users are granted complimentary access to the Priority Pass lounges and are allowed a maximum of two accompanying guests each. For any additional guests, your card will be charged $27 per guest, per visit. I apologize for the very long comment and I appreciate you getting this far reading it. Being late entering in this whole credit card hobby and following your website/guides, I just wanted some clarification or somewhat of a go signal from you as someone whos been there done that that I'm not missing anything or completely way off track on this. Aside from the obvious reward points that I can grasp, seeing all the other benefits listed looks really appealing but not being able to fully take advantage (or understand lol) of them is kinda sad. Thanks for your time!

Max

thanks for the great article. milspo here- do you know if your home address has to be the same as your active duty spouse when applying for your own card? i’m already an authorized card holder under my husband’s account, but after reading this blog post I want to open my own account to maximize the benefits!

Hey Raquel, your home address does NOT need to be the same as your active duty spouse. The system only checks if your Social Security Number is eligible for MLA benefits in the MLA database. If you haven’t had your own annual fee waived credit card account before, I recommend confirming your Military Lending Act eligibility in the MLA database. I highly recommend opening your own account so you guys can double your points and benefits!

Hey Spencer, thanks for the great posts. I’ve shared with my friends. Question: can I get another 100k point welcome bonus for a second AMEX platinum card? I already have a standard one. If yes, which one is your recommended choice as of Aug 2022. If no, can I get the welcome bonus on a gold card and upgrade to a Delta, or Bonvoy platinum? Thanks

Yes you can. I recommend the Charles Schwab Amex Platinum card. Probably the best of the other flavors. Usually 60,000 welcome bonus points after minimum spend.

My husband is currently in Air Force Reserve. I am a civilian. He will be on active duty order next year for 6months. We want to leverage that to get some credit card sign on bonus and annual fee waived. We are looking at Amex Delta Reserve and CSR for both of us. Since we can not suffice all the welcome bonus spending requirements fir 4 credit cards in just 6months, I am wondering if we can start getting the credit cards and pay the annual fee now, and once he is on active duty next year, we will apply for SCRA to refund the annual fee. Can we do that? It seems you do have some data points with past 10-year annual fee waived for the service member. Does it work for civilian spouse as well? Thank you.

I have members that are reservist that do their 15 days of annual training a year and most of the time up to 30. Most of these days are broken up but total up to 30 days a year. I heard that still applies vs the 30 consecutive days. Have you heard this before?

I have not heard this but it makes sense if you can show cumulative active duty orders for 30 days in a year.

I am National Guard but have been on Title 32 orders since 2016. I have Amex Delta Reserve and Chase Sapphire with fees waived. I usually would just go in and update my orders under the SCRA link on their websites. With that being said, I checked both the MLA site and the SCRA site and my name is reported back as no active duty/nothing on file. I’m concerned because I want my husband to apply for a card (Amex Plat) and want to make sure the fee will be waived. However, my name is not populating. Have you seen that happen? Is it an issue?

Did you check his name in the database? You could try opening the account and submitting your orders. Worst case scenario you pay the annual fee for one year and then close the account, but I think if you have the active duty orders they should waive it since you are Guard. Much easier though if you and him show up in the database.

Did you confirm in DEERs? You should be able to log in through your mil connect to update.I currently have three authorized users on my platinum and would like to add two more. They have not charged me any authorized user fees at this point. Will adding a fourth and fifth result in $175 fee (x2 if I add both of them)?

There should not be any additional authorized user fees charged if you’re a covered borrower under MLA.

Hi Spencer, The fee is only for active duty, right? I retired in 2017 from the ARMY. But, I can check with them (AMEX) for the benefit when I was on active duty right? Very Respectfully, Erick

You would have needed to open the account while on active duty. Did you do that?Spencer, Have you heard of Amex not honoring MLA for accounts opened before October 3, 2017? I’ve been active duty since May 2008, and Amex is insistent that any accounts opened after that date and before October 2017 aren’t eligible. I work with a bunch of other active duty folks in similar situations who have their Amex Platinum annual fees waived, no problem, but mine is not. I’m wondering if they all got lucky? Thanks!

Have you applied for SCRA benefits?I have. Amex says that because my Platinum account was opened after May 2008, I am not eligible for that either. When I opened the account, it was eligible for SCRA, but Amex later started charging me the annual fee. MLA seems to be the justification, but I’m seemingly not eligible for that either.

I have. When I opened the account (before Oct 2017) it was eligible for SCRA, but now they’re saying that because it was opened after I became active duty, my Platinum account is not eligible for SCRA. I’ve spoken to six different people at Amex who seem to know nothing about SCRA or MLA, but from what I can figure, once MLA was enacted, SCRA rules changed. Now I seem to be eligible for neither.

Closing and reopening the account would probably be the easiest way to fix this. Just make sure you have a Amex Gold or Green card to “store” your Amex Membership Rewards points on.