- Get $5 for Signing Up

- Cash Card Boosts

- Refer Friends

- Social Media Contests

- Buy Bitcoin

- Free ATM Reimbursements

- Borrowing from Cash App

- Investment Options

- Fake Cash App Customer Service

- Fake Giveaways

- Gift Card Scams

- Fake Referral Bonuses

- Lottery Game Scams

- What are the Cash App fees?

- How do I get a Cash App Account and a Free $5?

- Is Cash App Safe?

- Cash App vs CashApp: What’s the Difference?

- Venmo

- PayPal

- Zelle

- Pros

- Cons

How Cash App Works

Cash App is a digital wallet similar to Venmo but with several additional features. It’s owned by Square, the payment platform that many small businesses use to complete debit card and credit card payments.

As a bit of random trivia, the app was known as Square Cash before rebranding as Cash App.

You can use Cash App for these functions:

- Paying for purchases

- Sending money to friends

- Receiving money from friends

- Enrolling in direct deposit

- Digital banking

- Investing

The app is free to use but you can expect a small fee for miscellaneous services like instant deposits or funding money transfers with a credit card.

You can also use a complimentary debit card to pay for in-person purchases or scan a QR code to facilitate contactless payments – if the vendor has that option available.

How to Get Free Money with Cash App

Here are several ways you can earn money on Cash App. Some activities may require a purchase to earn rewards.

Get $5 for Signing Up

Do you want to make some easy bonus cash? You’ll need a Cash App free money code to get you there.

Use Wallet Hacks’s referral promotion code JKJDBWT (click to copy referral code) to earn $5 bonus cash by joining Cash App and completing a minimum $5 transaction in the first 14 days.

Paying for a purchase or sending money to another Cash App user lets you earn the bonus.

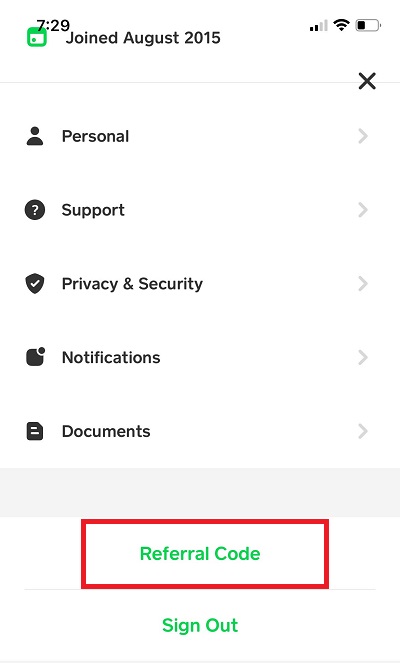

Here is the step-by-step process to enter the referral code:

- Install the Cash App to your Android or iOS device

- Tap the “Personal Settings” icon (also your face at the top right corner)

- Scroll to the bottom of the menu and press the green “Referral Code” button

- Enter the Cash App free money code JKJDBWT (click to copy referral code)

- Make a minimum $5 money transfer to a friend or some other transaction within 14 days

If you want to send money to a friend, you will need their $cashtag username. It’s also possible to look them up by email or phone number. (mine is $wallethacks *wink wink*)

You can hit “Send Money” to transfer money to a friend. Another option is by having your friend request money and you fund the exchange with your Cash Card debit card.

Want an extra $20 from Netspend?

Netspend is a prepaid card with no monthly fee and they will give you $20 when you open an account with referral code 3036538070 and deposit $40 in cash or with Direct Deposit. More details on this offer here.

Cash Card Boosts

One of the most consistent ways to earn cash rewards is by getting the free Cash App Visa debit card and activating spending boosts for one-time discounts at participating merchants.

This debit card is your lifeline to finding free money on the Cash App. Without the Cash Card, it’s challenging to get cash rewards with the app.

You can use your card for online purchases immediately but it can take up to two weeks to receive your physical card for in-store shopping.

After receiving your Cash Card, you can pay for online and in-store purchases such as:

- Domino’s

- DoorDash

- Playstation Store

- Starbucks

- Taco Bell

The app offers Boost instant discounts at popular local and online retailers. Most discounts are between 5% and 15%.

These time-sensitive offers can be an excellent way to save money on purchases you plan on making soon.

The Cash Card debit purchases don’t earn automatic cash back like cash back credit cards, instead, it allows you to qualify for discounts. But debit rewards cards are a growing trend and you can consider using your Cash Card when you find a relevant Boost.

Refer Friends

Referring friends is another easy way to get free money as new users join Cash App. It’s possible to earn $5-15 per friend.

After creating your account, you can start referring friends. You will see an “Invite Friends” button on the personal account tab.

There are three ways to invite friends:

- Have Cash App invite your friends: The app can scan your phone contact list to find friends who currently don’t use the app.

- Enter a phone number: You can manually enter a phone number and Cash App sends a text message invite link

- Enter an email address: You can also submit your friend’s email address and Cash App sends an invite email with step-by-step instructions.

Your friends will need to enter your referral code before they and you earn bonus cash.

Admittedly, entering the referral code isn’t as streamlined as other apps since your friends won’t receive a prompt to enter the code as they create an account.

They will first need to make an account and find the referral code button inside the app.

Need a referral code? If you’re a new Cash App user, install Cash and enter code JKJDBWT before making a qualifying minimum $5 transaction.

Social Media Contests

Many companies post special rewards and discounts on their social media channels. You can find recurring Cash App contests on Instagram and Twitter.

You can enter the giveaways to win free cash by entering your $cashtag and necessary hashtags on your social media posts.

A popular giveaway is on Fridays to potentially win cash with hashtag #CashAppFriday.

Winning isn’t guaranteed but it’s free to try and you can have some fun in the process.

Buy Bitcoin

You can also get exposure to Bitcoin in the app. The purchase minimum is $1 per purchase and small trading fees may apply. You will see any applicable fees during the trade preview.

In addition to buying Bitcoin, you can transfer up to $10,000 of an existing Bitcoin balance in a 7-day period.

Other Cash App users can send you Bitcoin positions when you provide your $cashtag.

The app only supports Bitcoin (BTC). You won’t be able to trade or transfer other Bitcoin variants like Bitcoin Cash (BCH) or Ether (ETH).

Bitcoin Boost

It’s possible to earn free Bitcoin by making qualifying purchases with the Cash App debit card. However, instead of earning cash rewards on the shopping offers, you get Bitcoin rewards.

This feature can be an easy way to increase your exposure to this alternative investment. You might consider it if you like the potential investment upside if the market value of Bitcoin increases.

However, cash rewards can be the better option if you prefer the stability of fiat currency or need cold, hard cash for life’s expenses.

Online Banking

The app also offers several online banking features.

The Cash App bank is Lincoln Savings Bank (FDIC# 14207) and Sutton Bank (FDIC# 5962).

You receive a routing number and an account number that you can give to employers to accept payments via direct deposit. You can also provide these banking details to government agencies to get benefits like the expanded Child Tax Credit, unemployment benefits, or stimulus payments.

Some of the online banking features include:

- Free Cash Card debit card with a customizable design

- Receive direct deposits up to two days early

- Receive tax refunds for federal or state tax returns

- Recurring deposits from linked debit cards and bank accounts

- Mobile check deposit

It’s free to send and receive money with a personal Cash App account for most reasons. If you upgrade to a business account, you pay 2.75% to receive money but sending money is free when using your debit card.

The platform doesn’t offer online bill pay but you can enter your debit card or banking details on the merchant website to enroll in automatic payments.

Also, your Cash App banking account doesn’t earn interest. Instead, you should transfer your excess cash to a high-yield savings account.

Free ATM Reimbursements

While you won’t automatically get free money by using the online banking feature, there is a way to get free ATM withdrawals.

Receiving at least $300 in monthly direct deposits means Cash App reimburses your first three ATM withdrawal fees per 31-day period. The reimbursement limit is $7 per withdrawal (up to $21 per month).

Without the ATM fee reimbursement benefit, the app charges $2 per withdrawal plus the network provider fees.

Unfortunately, Cash App doesn’t provide a fee-free ATM network like most online banks.

Borrowing from Cash App

Cash App offers the ability to borrow money for a short time frame with a reasonable fee. This is available to users who make regular deposits to their account, up to $200 in lending if you regularly deposit $1000 each month. The loan is only for four weeks and the fee is a flat 5%.

When you borrow, you are not charged interest unless you do not pay back the loan within the four week time frame. After four weeks, you have a one week grace period and then 1.25% interest of interest is added to each payment.

Invest in Stocks

You can invest as little as $1 in individual stocks and ETFs commission-free.

It’s possible to make recurring income if you hold dividend stocks or can trade stocks for a profit if you “buy low and sell higher.”

The app currently isn’t offering investing rewards if you schedule recurring buys or initially fund your account. But that doesn’t mean limited-time promotions won’t appear every so often.

Your Cash App investing account is a taxable brokerage account and it can be good for investing small amounts of money.

Other investing apps can be better if you want the tax benefits of an individual retirement account (traditional IRA or Roth IRA).

Investment Options

The investment options include:

- Individual stocks: There are many stocks from various sectors, including banks and tech trading in the S&P 500 and smaller indexes.

- ETFs: There are many index and sector ETFs available. These funds have low fund expenses and can help you quickly diversify.

Whether you invest in stocks, ETFs, or dabble in both, there is a “Dividend Yielding” filter. This feature lists companies and funds that have paid a dividend in the last 180 days.

A stock screener can also help you find quality stocks that fit your investment strategy.

Cash App Scams

Most people love the concept of getting free money but think it’s too good to be true. In some cases, it is.

Here are some common Cash App scams to watch out for so you don’t give a fraudster some of your hard-earned dollars.

Fake Cash App Customer Service

Crooks will impersonate Cash App customer service members. For example, they might send you direct messages via social media, text, or email. When in doubt, look for correspondence in the app to verify offers are legit.

The Cash App social media channels and in-app help section detail common scams too.

Fake Giveaways

Impersonators may launch fake giveaways or respond to your social media entries saying you’ve won a reward. Take the time to make sure the posts come from the verified Cash App accounts only.

Also, the official Cash App social media sweepstakes won’t require making a purchase.

Gift Card Scams

Some scams encourage the victim to make a purchase with the promise of getting a larger reward. A common tactic is having the victim buy a digital gift card and send the card number to the scammer for “verification.”

Instead, the fraudster takes the money and runs.

Some scams have you send money directly to another Cash App account but you never get money back.

Fake Referral Bonuses

Fraudsters may also have you sign up for different apps and earn a referral bonus. Simple scams have you do all the work but the referral bonus deposits into another $cashtag.

Lottery Game Scams

Some websites may have you play an instant win lottery game and win as much as $500. First, you enter your $cashtag and then spin the wheel until you “win.”

Once you get a winning spin, you have to complete several offers from an offer wall. For example, you may have to download a free app and use it for at least 30 seconds.

While you can make money testing apps with get-paid-to sites, you only earn a few dollars for similar effort – not hundreds of dollars.

Cash App FAQs

The Cash App has many features and as more people adopt the app as a payment method, these questions may arise.

What are the Cash App fees?

The Cash App is less likely to charge fees than a traditional checking account and debit card but you may encounter several expenses.

Here is the current list of common platform fees:

- Monthly service fee: $0

- Debit card order fee: $0

- ATM withdrawals: $2 plus network fees

- Cash-to-Cash transfers: $0

- Standard cash withdrawals to a linked bank account: $0

- Instant deposits to a linked debit card: 1.5% of transaction amount ($0.25 minimum)

- Send money from a credit card: 3%

- Stock and ETF transactions: $0 to buy and $0 to sell

- Bitcoin transactions: Variable transaction fees to buy or sell

Business accounts will pay a 2.75% transaction fee to receive payments but no fees to send money.

How do I get a Cash App Account and a Free $5?

First, you download the Cash mobile app to your Android or iOS device. Next, you enter your name and link a phone number or email.

After the initial account setup, you can connect Cash App to an existing bank account or debit. There is also the option to order a free debit card necessary to earn free money, including the new customer referral bonus.

You can enter referral code JKJDBWT in the account settings menu to earn $5 bonus cash with a minimum $5 transaction.

Is Cash App Safe?

The Cash App is safe to use for making purchases and transferring funds to people you know and trust. This digital wallet app is several years old and a subsidiary of the Square payment software many small businesses use.

As always, you should be cautious and screen for Cash App scams. Fraudsters may impersonate Cash App customer service agents or their social media channels. Unfortunately, this trend is common with other apps too.

Cash App vs CashApp: What’s the Difference?

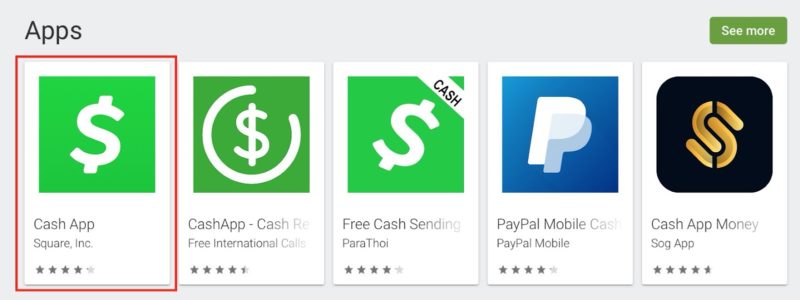

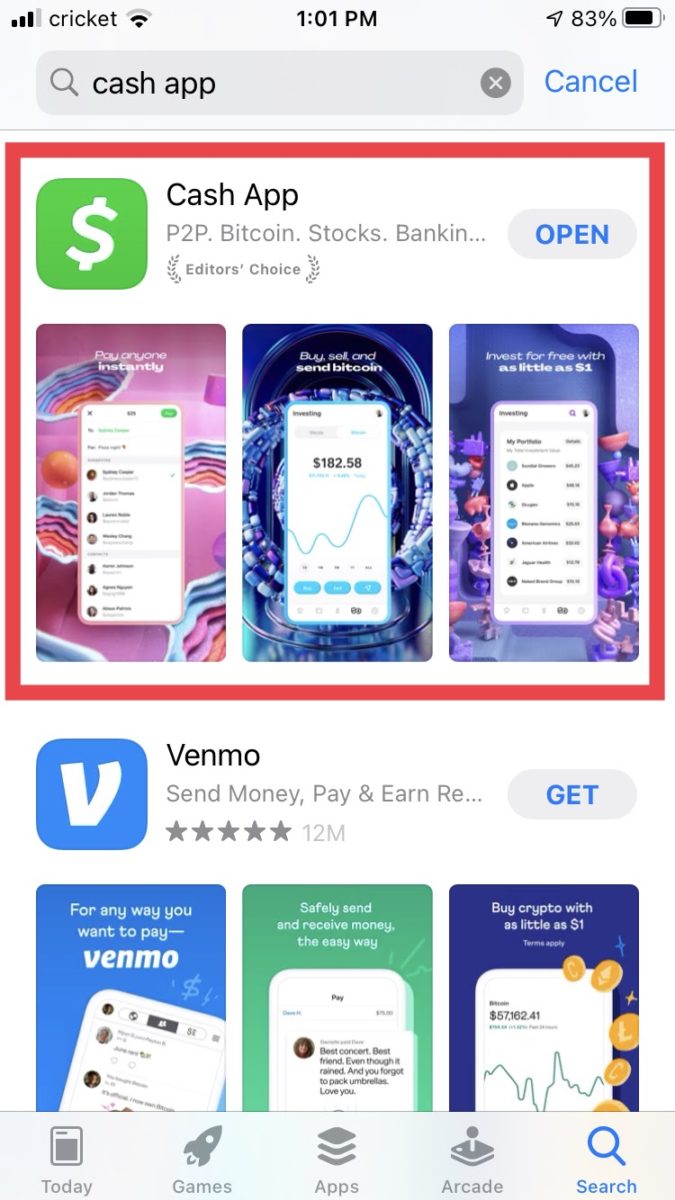

When you’re looking to download the Cash App, there’s a chance you might download the wrong app by accident in App Store or Google Play Store.

You see, there’s Cash App (the one you want – with a space between the words) and CashApp (all one word).

You want to install Cash App with Square Inc. as the developer.

The other CashApp lets you earn free money completing online tasks – like Swagbucks. However, it has no relation to the Square Inc. Cash App that we’re covering in this article.

This is the icon to look for in the Google Play Store:

Below is the icon to look for in the App Store:

Choose one of these links to download Cash App to your phone:

- App Store (iOS devices)

- Google Play (Android devices)

Cash App Alternatives

The Cash App is a legit way to get free money, pay for purchases, and transfer money between friends. You might find yourself using these money-sending apps more frequently.

Venmo

Venmo is a subsidiary of PayPal and has a debit card-focused platform similar to Cash App. This app makes it easier to send money with a credit card, but the sender pays a 3% transaction fee.

You won’t pay any transaction fees when you send money with a debit card.

Some of the other reasons to consider Venmo include:

- More fee-free ATMs: No withdrawal fees for MoneyPass network ATMs

- Several cryptocurrency investment options: Bitcoin, Ethereum, LiteCoin, and Bitcoin Cash

- Rewards credit card: 3% cash back on purchases and no annual fee

You won’t be able to trade stocks on Venmo. Also, the cryptocurrency transaction fees can be potentially higher than with Cash App.

Is Cash App or Venmo Better?

Cash App and Venmo have many similar banking features with minimal fees.

The better payment app might be the one the majority of your friends use. For example, you can’t transfer funds between Venmo and Cash App.

Both apps let you perform these functions:

- Send money to friends for free

- Receive money from friends for free

- Split purchases between friends

- Receive direct deposits with a routing number and account number

- Free debit card

- Earn cash rewards at select merchants (Cash Boosts and Venmo Offers)

- Ability to make fee-free ATM withdrawals

- Buy or sell cryptocurrency

Cash App can make it easier to avoid fees when sending money as you will need to link a debit card or bank account. It’s more challenging to link a credit card than with Venmo.

Cash App can be better than Venmo for these reasons:

- New members can receive a referral code to get bonus cash

- Can trade stocks and ETFs

- Fund transfers may be quicker

- You can reload the Cash app card in a lot of places

Venmo can be better than Cash App for these reasons:

- No withdrawal fees at domestic MoneyPass ATMs

- More cryptocurrency trading options

- More funding options for money transfers (extra fees may apply)

- A Venmo Credit Card is available and can earn cash back

You may prefer Venmo if you can easily access the approximate 24,000 surcharge-free MoneyPass ATMs. Unfortunately, Cash App doesn’t offer a fee-free network and charges a $2 withdrawal fee on top of any network fees. Receiving at least $300 in direct deposits waives the first three charges (up to $7 per month) but not having instant access to free ATMs can be frustrating.

PayPal

While more people and businesses are adopting Cash App and Venmo, legacy apps like PayPal continue to have a giant portion of the market share.

This app makes it easy to pay for purchases and send money to friends with a credit card or debit card.

Its cryptocurrency investment options and trading fees are similar to Venmo. Plus, they offer “Buy Now, Pay Later” extended payment options qualifying purchases.

Zelle

Zelle can be an excellent option if you and your friends only need to transfer money with each other. Many banks integrate with Zelle and let you complete transfers instantly. There are limits to how much you can send via Zelle but they’re fairly high.

Friends that don’t have the Zelle feature in the bank app can also receive money by downloading the Zelle mobile app.

You won’t get a separate debit card or an investment account like Cash App offers. However, you also have one less banking account you need to monitor for potential fraud.

Cash App Pros and Cons

Here is a brief recap of the positives and negatives of the platform.

Pros

- Can earn cash back on participating debit card purchases

- No fees to send or receive money between friends and family

- Offers banking and investing services

- No monthly service fees

Cons

- Must have qualifying direct deposits to waive ATM fees

- Banking account lacks features of most free checking accounts

- Won’t earn interest on savings or every debit card purchase

- Cannot send money to non-Cash App payment apps

Summary

There are a few legit ways to get free money on the Cash App. In fact, you can earn $5 by signing up with our new user referral code, JKJDBWT, and sending at least $5 to a friend. You can also earn debit card shopping boosts and enter social media giveaways. Linking your account to other rewards apps can also let you easily receive payment when it’s time to cash out.

Other Posts You May Enjoy:

Apps Like Earnin: 6 Earnin App Alternatives for 2024

Earnin is a popular fintech app designed to give you early access to your paycheck without a high-interest payday loan. Other features include low balance alerts and the chance to win free cash when you put money into savings. But Earnin isn’t the only app of its kind. Here are 16 other apps that provide similar features to Earnin.

Best Free Debit Cards for Kids & Teens

Allowing your children to use debit cards is a great way to teach them how to manage money. But what you don't want is to have to pay fees. Thankfully, several banks offer debit cards for kids to use with their parents. Here are 10 free debit cards for kids and teens and a few low-cost options.

CreditFresh Review: Quick Credit Approvals – Is it Worth the Cost?

CreditFresh offers a line of credit that allows you to make on-demand withdrawals. It’s possible to qualify for a borrowing limit between $500 and $5,000 while avoiding hidden fees. This CreditFresh review covers the strengths and weaknesses of this borrowing option and whether this is the best way to borrow money.

$50 Loan Instant App: The Best Apps for Instant Money (plus Alternatives)

A $50 loan instant app refers to apps designed to get you small amounts of money in an instant, until your next paycheck. Here are the top $50 loan instant apps and some alternatives. The instant loan apps listed here might be a good solution if and when you experience a cash shortfall.

Share This Post:

About Josh Patoka

After graduating in $50k with student loans in May 2008 from Virginia Military Institute with a B.A. International Studies and Political Science with a minor in Spanish (he studied abroad in Sevilla, Spain for 3 months), Josh decided to sell his soul for seven years by working in the transportation industry to get out of debt ASAP and focus on doing something else with a better work-life balance.

He is a father of three and has been writing about (almost) everything personal finance since 2015. You can also find him at his own blog Money Buffalo where he shares his personal experience of becoming debt-free (twice) and taking a 50%+ pay cut when he changed careers.

Today, Josh relishes the flexibility of being self-employed and debt-free and encourages others to pursue their dreams. Josh enjoys spending his free time reading books and spending time with his wife and three children.

Opinions expressed here are the author's alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.